United States energy law

United States energy law is a function of the federal government, states, and local governments. At the federal level, it is regulated extensively through the United States Department of Energy. Every state, the federal government, and the District of Columbia collect some motor vehicle excise taxes.[1] Specifically, these are excise taxes on gasoline, diesel fuel, and gasohol.[1] While many western states rely a great deal on severance taxes on oil, gas, and mineral production for revenue, most states get a relatively small amount of their revenue from such sources.[2]

The practice of energy law has been the domain of law firms working on behalf of utility companies, rather than legal scholars or other legal actors (such as private lawyers and paralegals), especially in Texas, but this is changing. Some officials from energy agencies may take jobs in the utilities or other companies they regulate, such as the former FERC chairman did in 2008.[3]

The American Bar Association (ABA) has a Section of Environment, Energy, and Resources, which is a "forum for lawyers working in areas related to environmental law, natural resources law, and energy law."[4] The Section houses several substantive committees on environmental and energy law that release current information on topics of interest to practitioners and news of committee activities.[5] The ABA recognized 'environmental and energy law' as one of the practice areas where legal work may be found in 2009.[6]

The United States' oil production peaked in February 2020, at about 18,826,000 barrels per day.[7]

Common law

[edit]Under the common law, persons who owned real property owned "from the depths to the heavens".[8][9] Therefore, real estate traditionally has included all rights to water, oil, gas, and other minerals underground.[8] The United States Supreme Court has held that as far as air rights, "this doctrine has no place in the modern world,"[10] but it remains as a source of law to this day, or "fundamental to property rights in land."[8]

An easement or license to drill for oil, gas, or minerals generally runs with the land, and thus is an appurtenant easement.[citation needed] However, a utility easement generally runs with the owner of the easement, rather than running with the land, and as such, is an example of an easement in gross.[citation needed]

The West digest system, used in WestLaw, has allocated several topics in energy law:

- 114 – Customs duties

- 145 – Electricity

- 190 – Gas

- 371 – Taxation.

There are many library research resources available about American oil and gas law.[11]

Federal laws

[edit]Previous to the 1920s, the role of the federal government in energy was restricted to the disposition of oil, gas, and coal on federal lands. The Mineral Leasing Act of 1920 30 U.S.C. § 181 et seq. is the major federal law that authorizes and governs leasing of public lands for developing deposits of hydrocarbons and other minerals. Previous to the act, these materials were subject to mining claims under the General Mining Act of 1872. In BP America Production Co. v. Burton, 549 U.S. 84 (2006), the Supreme Court held that a statute of limitations does not apply to government actions for contract claims for an agency to recover royalties on such leases.

Concerned that a predicted imminent shortage of petroleum would not leave enough fuel for naval vessels, President William Howard Taft established the first Naval Petroleum Reserve by withdrawing federal land over the Elk Hills Oil Field in California from being claimed and drilled by private companies. A number of additional Naval Petroleum Reserves and Naval Oil Shale Reserves were established by Taft and his successor, Woodrow Wilson.

Until the 1920s, "the federal government did not play an active role in the energy industries," sometimes explained as due to "the widespread belief in the unlimited supply of energy."[12] The first US law was the Federal Power Act of 1920 (later amended in 1935 and 1986).[12][13][14][15] The Manhattan Project of the 1940s "initiated the era of nuclear regulation."[12] In 1946, the Atomic Energy Act was passed.[16]

The Price-Anderson Nuclear Industries Indemnity Act was first enacted in 1957, and has been renewed periodically, which governs a no-fault insurance regime for nuclear accidents.[17] The statute was upheld as constitutional in Duke Power Co. v. Carolina Environmental Study Group, 438 U.S. 59 (1978).[18]

The Department of Energy and its constituent Federal Energy Regulatory Commission (FERC) were created in 1977,[12] through the Department of Energy Organization Act.[19] The stated purposes of these "federal energy laws and regulations is to provide affordable energy by sustaining competitive markets, while protecting the economic, environmental, and security interests of the United States."[12] The U.S. Nuclear Regulatory Commission (NRC) regulates the use of nuclear power and its uses as a defense weaponry.[12]

Other statutes are the Public Utility Regulatory Policies Act,[20] the Energy Security Act,[21] the Price-Anderson Nuclear Industries Indemnity Act, and the Energy Policy Act of 1992[22] Most of these laws are codified at U.S. Code, Title 16, Chapter 12 – Federal regulation and development of power. The Commodity Futures Modernization Act of 2000 also affects energy trading companies. The Oil Pollution Act of 1973 and Oil Pollution Act of 1990 affect the transportation of oil on the high seas.

As of January 1, 2008, the federal excise tax was 18.3 cents per gallon on gasoline, 24.3 cents per gallon on diesel, and 13 cents per gallon on gasohol.[1]

Energy Policy Act of 2005

[edit]The most recent major law is the Energy Policy Act of 2005, an attempt to combat growing energy problems, which changed the energy policy of the United States by providing tax incentives and loan guarantees for energy production of various types. [23][24][25] There were various criticisms of the Act.[26][27] One of the most controversial provisions of that Act was to change daylight saving time by four to five weeks, depending upon the year;[28] some scholars have questioned whether daylight saving results in a net energy savings.[29] It also directs a study for the development of oil shale and tar sands resources on public lands especially in Colorado, Utah, and Wyoming.[30] The Act further sets Federal reliability standards regulating the electrical grid (done in response to the Blackout of 2003).[31][32][33] There was also criticism of what was not included: the bill did not include provisions for drilling in the Arctic National Wildlife Refuge (ANWR) even though some Republicans claim "access to the abundant oil reserves in ANWR would strengthen America's energy independence without harming the environment."[34] There are a number of tax credits in the Act, including the Nonbusiness Energy Property Tax Credit.

Developments 2007 to present

[edit]

Two federal laws passed in 2007 were the Energy Independence and Security Act of 2007,[35][36] and the Food and Energy Security Act of 2007.[37]

The auto industry said federal regulators are pushing too far, too fast in their effort to raise fuel-mileage rules. The complaints from the industry, which had previously voiced support for tougher standards, underscore how economic hardship is affecting a major policy debate.

— The Wall Street Journal[38]

The Biomass Research and Development Board was expected to release a report in late 2008 about biomass as fuel.

In August 2008, it was revealed that oil speculators had increased the volatility of the price of oil; Congressman John Dingell criticized the Commodity Futures Trading Commission for failing to scrutinize oil futures traders, in particular the Swiss company Vitol.[39] On June 22, 2008, Obama proposed the repeal of the Enron loophole as a means to curb speculation on skyrocketing oil prices.[40]

In October 2008, as the Democratic Party approached victory in the 2008 elections, they remained divided on energy policy, thus a consensus was not expected in energy law.[41] President Barack Obama's first Secretary of Energy, Steven Chu,[42][43] had no prior expertise in law.

The Department of Energy (DOE) will, by administrative measures, reduce the Hanford nuclear reservation (originally 586 square miles) to 10 square miles.[44] Much of the remaining area will go to the 300-square-mile (780 km2) Hanford Reach National Monument.[44]

In October 2009, Secretary Chu announced a new program, Arpa-e, which will fund grants authorized under the Energy Independence and Security Act of 2007.[45]

The "Energy Credit for Qualified Fuel Cell Property and Qualified Microturbine Property" was created in 2008,[46] but it appears to have expired as of 2013.

Individual taxpayers may claim several energy credits to reduce their federal income taxes, if they file the Long Form 1040 along with Form 5695 attached. These include the "Resident energy efficient property tax credit", and starting in the 2012 tax year, a "nonbusiness energy property credit".[47] Some of these provisions were extended by ARRA (see below) and by later bills.[48]

American Recovery and Reinvestment Act of 2009

[edit]

As part of the $787 billion stimulus package or "ARRA" (technically the American Recovery and Reinvestment Act of 2009),[49]

US law now allows rebates for energy efficient products and for weatherization.[50] Energy law and policy are significantly affected by this new law.[51][52][53][54]

State laws

[edit]The states affect energy in numerous ways, including taxes, land use controls, regulation of energy utilities, and energy subsidies. States may establish environmental standards stricter than those set by the federal government. Regulation of oil and gas production, particularly on non-federal land, is largely left up to the states.

Alaska law

[edit]

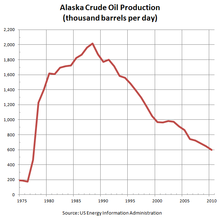

Alaska has vast energy resources:

- Major oil and gas reserves are found in the Prudhoe Bay area of the Alaska North Slope (ANS) and Cook Inlet basins. According to the Energy Information Administration, Alaska ranks second in the nation in crude oil production, accounting for 1/5 (20%) of United States oil production, Prudhoe Bay alone accounting for 8% of the United States domestic oil production.[citation needed]

- The Trans-Alaska Pipeline pumps up to 2.1 million barrels (330,000 m3) of crude oil per day, more than any other crude oil pipeline in the United States.

- Substantial coal deposits are found in Alaska's bituminous, sub-bituminous, and lignite coal basins. The United States Geological Survey estimates that there are 85.4 trillion cubic feet (2,420 km3) of undiscovered, technically recoverable gas from natural gas hydrates on the Alaskan North Slope.[55]

- Alaska also offers some of the highest hydroelectric power potential in the country from its numerous rivers, and large swaths of the Alaskan coastline offer wind and geothermal energy potential as well.[56] As of 2001, the state's Energy Plan stated that, although wind and hydroelectric power are abundant, with low-cost electric interties they were judged uneconomical.[57]

Likewise, Alaska receives a large proportion of its state revenues from its severance tax on oil: a full 68% of all revenue, much more than any state (only Wyoming coming close).[2] Its dependence on petroleum revenues and federal subsidies allows it to have the lowest individual tax burden in the United States.[58][59]

The state created the Alaska Permanent Fund from this "golden egg", which is owned and managed by the state, and "created by a constitutional amendment":[60]

In November 1976, Alaskans voted to amend their state constitution to create the Permanent Fund. The state constitution and supporting statutes set out the Fund's purpose and how it works.

— Alaska Permanent Fund[61]

The constitutional provisions are found at Alaska Constitution Article IX, Section 15.[62] Statutes regulate how the Fund is to be invested,[63] as well as how the income is to be disbursed.[64] Regulations state additional details regarding control of the Fund.[65]

The federal government runs the Alaska Natural Gas Transportation Projects, which are new pipelines, and its "Federal Coordinator" (director) is nominated with advice and consent of the Senate by the President of the United States.[66][67] Drue Pearce was the first director; she was nominated by George W. Bush and served from December 13, 2006, through January 3, 2010.[66][67] Larry Persilly is the current coordinator; he was nominated by Barack Obama on December 9, 2009, and was confirmed by the United States Senate on March 10, 2010.[68]

California law

[edit]The most populous state in the United States, California has gone through a series of energy crises, and has reacted with several laws concerning energy. The California Energy Code, or Title 24 of the California Code of Regulations, also titled "The Energy Efficiency Standards for Residential and Nonresidential Buildings", were established in 1978 in response to a legislative mandate to reduce California's energy consumption. The standards are updated periodically to allow consideration and possible incorporation of new energy efficiency technologies and methods, such as the programmable communicating thermostat.[69]

California assesses an excise tax with the same basic rate of 18 cents per gallon on gasoline, diesel fuel, and gasohol.[1] The state collects a relatively small 6.6 percent of its revenue from extraction and related taxes.[2]

New Mexico law

[edit]As a major energy producer, New Mexico has government offices related to energy, including the Energy Conservation and Management Division,[70] which is part of the state's Energy, Minerals and Natural Resources Department.[71] All of the major laws impacting energy are available from the Division's website.[72] These include links to all of the state's statutes and related government websites, federal and state regulations, and executive orders.[72]

Uranium mining in New Mexico had been significant from about 1950 until 1998.[73] Several oil and gas companies developed uranium ore mines in New Mexico during that period.[74] As of 2007, at least one company was evaluating development by in-situ leaching; there are potentially large deposits of coffinite and uranium oxide ores available in New Mexico.[75]

New Mexico has enacted a number of new laws related to energy, including to create a New Mexico Renewable Energy Transmission Authority and to increase its renewable portfolio standards.[72][76] According to one law firm's summary of President Obama's Economic Recovery Package, the state stands to gain much from the new administration, because "New Mexico leaders and laboratories are at the forefront of energy policy."[77] For example, former University of New Mexico Law School professor Suedeen G. Kelly was a member of the Federal Energy Regulatory Commission.[77][78][79][80]

The state collects an effective rate of 18.875 cent per gallon tax on gasoline and gasohol, and 22.875 cents per gallon on diesel.[1] Like many western states, it collects significant revenue from extraction taxes—20.9 percent of its overall sources.[2]

The city of Albuquerque passed an ordinance to regulate "efficiency standards for heating and cooling equipment," which was struck down by the U.S. District Court as violating the Commerce Clause of the U.S. Constitution.[81]

The town board of Taos passed a "strict new new building code" in 2009 that mandated energy savings:

The ordinance ... mandates that residential construction meet Home Energy Rating System standards that gradually phase in starting this year, and commercial construction must meet Leadership In Energy and Environmental Design certified standards beginning this year.

— AP report, March 4, 2009.[82]

The town debated the proposed Ordinance 08-16, High Performance Building Ordinance, starting in October 2008,[83] postponed it for legal review,[84] debated it in February 2009,[85] and passed it in March 2009.

The New Mexico Gas Company offers an Energy Star Home Rebate.[86]

In October 2009, Governor Bill Richardson announced 21 grants for energy projects that were being funded by $8 million in ARRA funds.[87][88]

New York law

[edit]New York has an Energy Law.[89] Under New York law, "energy" and "energy resources" are defined as:

Energy" means work or heat that is, or may be, produced from any fuel or source whatsoever. ... "Energy resources" shall mean any force or material which yields or has the potential to yield energy, including but not limited to electrical, fossil, geothermal, wind, hydro, solid waste, tidal, wood, solar and nuclear sources.

— N.Y. Energy Law § 1-103 (5) and (6).[90]

The chief regulator is the "Commissioner" or "president" of the New York State Energy Research and Development Authority (also called NYSERDA).[91][92] The board of directors of NYSERDA includes—as a matter of law—several utility insiders, as well as ex officio commissioners.[92][93] Vincent DeIorio, a lawyer, is chairman of the board,[94] and Francis J. Murray Jr. is President and CEO. NYSERDA was created as a public benefit corporation under NY law.[95][96] New York's other regulatory bodies and entities include the New York State Public Service Commission, the New York State Department of Health, the New York Power Authority, and the Long Island Power Authority.

In addition to Energy Law, the state has a variety of laws regulating and taxing energy, and its courts have issued significant case law concerning energy taxes. Two trial court cases in 2012 allowed local zoning law to pre-empt state law by effectively banning hydrofracking, but this is being appealed.[97]

Under New York law, both the New York Attorney General or a district attorney may prosecute alleged polluters who make oil spills.[98] The state has enacted a number of recent laws to control carbon emissions.[99]

The state collects an effective rate of 24.4 cent per gallon tax on gasoline and gasohol, and 22.65 cents per gallon on diesel.[1] New York collects one of the smallest amounts of revenue from extraction taxes of any state—only 5.8 percent of its overall sources.[2]

Texas law

[edit]

Oil, gas, and other energy resources are regulated by the powerful Texas Railroad Commission.[100] It is the oldest regulatory agency in Texas, having been created in 1891.[101] It "oversee[s] the Texas oil and gas industry, gas utilities, pipeline safety, safety in the liquefied petroleum gas industry, and the surface mining of coal."[101]

According to Forbes, the University of Houston has an "exceptional" energy policy and law program.[102]

Vermont law

[edit]The state of Vermont, like other states, has a comprehensive statutory scheme governing energy generation and transmission issues, colloquially referred to as "Section 248." The reference is to 30 V.S.A. Sec. 248, which is administered by Vermont's Public Service Board, a quasi-judicial board with three members. Section 248 is not to be confused with Vermont's comprehensive law governing land development and subdivision – Act 250.[103] The state has an independent energy distributor, the Vermont Electric Cooperative.

Wyoming law

[edit]Wyoming is the top coal producer of the 50 states in the United States, has significant oil and gas reserves, and its government and laws reflect an interest in energy production, especially fossil fuels.[104] The Wyoming Oil and Gas Conservation Commission regulates many aspects of oil, coal, and gas development in this resource-rich state.[105] There is an annual state Gas Fair.[106] The University of Wyoming is well known for its research on energy development.[104] The University sponsored a symposium on coal gasification in 2007.[107][108]

Wyoming assesses an excise tax with the same rate of 14 cents per gallon on gasoline, diesel fuel, and gasohol.[1] The state collects the largest percentage—46 percent of its revenue—from extraction and related taxes, the second highest of the states, surpassed only by Alaska.[2]

Governing has noted that starting in 2000, many observers have viewed the state's "overreliance on minerals taxes" to be "fiscally unhealthy", but it was rescued by the oil, gas, and coal boom; there remains a political wariness about imposing an income tax, yet in 2012 the state imposed a tax on wind turbines.[109]

Other state laws

[edit]Florida and South Carolina have instituted utility fees to finance planned nuclear reactors.[110]

Indiana passed in 2009 a law "that allows the state's finance authority to negotiate long-term contracts to buy and sell synthetic natural gas from a planned southern Indiana coal-gasification plant."[111]

Massachusetts Governor Deval Patrick successfully pushed for "clean energy initiatives" in the 2008 legislative session, calling it "one of the most productive in a long, long time."[112]

New Hampshire passed in 2008 an energy law, signed by Governor John Lynch, which "provides guidelines for residential wind energy systems ... such as height, noise, setbacks and aesthetics and outlines a process for input from neighbors."[113] This was found necessary because a University of New Hampshire student, Laura Carpenter, found that "most communities had no ordinances or zoning rules that specifically address small residential wind turbines."[113]

Ohio requires utilities to meet regulatory goals for conservation.[114]

Oregon has established a Energy Efficiency Center, one of 31 Industrial Assessment Centers.

See also

[edit]- Energy usage of the United States military

- Ethanol research

- Federal Energy Regulatory Commission (FERC)

- Philippine energy law (formerly a commonwealth of the United States)

- Strategic Petroleum Reserve (United States)

References

[edit]- ^ a b c d e f g Motor Fuel Excise Tax Rates as of January 1, 2008 from the Federation of Tax Administrators website. Retrieved February 24, 2009. Archived February 24, 2010, at the Wayback Machine

- ^ a b c d e f 2007 State Tax Collection by Source from the Federation of Tax Administrators website. Retrieved February 24, 2009.

- ^ "Former FERC Chairman Joins Husch Blackwell Sanders", August 4, 2008, found at Marketwatch story[permanent dead link]. Retrieved August 21, 2008.

- ^ Section of Environment, Energy, and Resources of the American Bar Association website. Retrieved August 22, 2008.

- ^ "Committee Finder". Retrieved 2024-03-24.

- ^ Deborah L. Cohen and Julie Kay, "Where the Work IS," ABA Journal, August 2009, pp. 58-61, at 59.

- ^ "U.S. Filed Production of Crude Oil". United States Energy Information Administration. May 31, 2022. Retrieved June 6, 2022.

- ^ a b c Thomas Merrill, Establishing Ownership: First Possession versus Accession, p. 14, fn. 22-23, Law and Economics Workshop (University of California, Berkeley 2007 Paper 3), found at CDLib website. Retrieved September 17, 2008.

- ^ Written as cjus est solum, ejus est usque ad coelum et ad inferos. This has been translated as "To whomever the soil belongs, he owns also to the sky and the depths." Black's Law Dictionary (6th ed. 1990). From Merrill, fn. 22, q.v..

- ^ United States v. Causby, 328 U.S. 256, 261 (1942), see 328 U.S. 256 (1946). From Merrill, fn. 23, q.v..

- ^ "OIL AND GAS LAW: A Selective Research Guide," from the Cooley Law School website. Retrieved July 28, 2010. Archived May 27, 2010, at the Wayback Machine

- ^ a b c d e f Cornell Law School website. Retrieved August 6, 2008.

- ^ Federal Energy Law Summaries online.

- ^ Federal Power laws online.

- ^ Federal Power Act Amendments Act of 2003 at The Orator website Archived February 4, 2012, at the Wayback Machine.

- ^ Pub.L. 1946, ch. 724, 60 Stat. 755, Pub. L. 60–755.

- ^ Pub.L. 1957, 85 Stat. 257, Pub. L. 85–257, codified at 42 U.S. ch. 23.

- ^ Duke Power Co. v. Carolina Environmental Study Group, 438 U.S. 59 (1978).

- ^ Pub.L. 95-238, 92 Stat. 47, Pub. L. 95–238.

- ^ PURPA, at Pub. L. 95–617

- ^ Pub. L. 96–294.

- ^ Pub. L. 102–486

- ^ (Pub. L. 109–58 (text) (PDF)).

- ^ "PUBLIC LAW 109–58—AUG. 8, 2005 ENERGY POLICY ACT OF 2005" (PDF). Archived from the original (PDF) on March 3, 2011. Retrieved July 2, 2014.

- ^ "Sec. 388". U.S.LibraryofCongress. 2005-08-08. Archived from the original on 2016-04-15. Retrieved 2008-07-11.

- ^ Grunwald, Michael and Juliet Eilperin. "Energy Bill Raises Fears About Pollution, Fraud Critics Point to Perks for Industry." Washington Post. July 30, 2005.

- ^ "Bush signs $12.3 billion energy bill into law." MSNBC. Aug. 8, 2005.

- ^ Alex Beam (2005-07-26). "Dim-witted proposal for daylight time". Boston Globe.

- ^ Ryan Kellogg; Hendrik Wolff (January 2007). "Does extending daylight saving time save energy? Evidence from an Australian experiment" (PDF). CSEM WP 163. University of California Energy Institute.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ "What's in the Oil Shale and Tar Sands Leasing Programmatic EIS". Oil Shale and Tar Sands Leasing Programmatic EIS Information Center. Archived from the original on 2007-07-03. Retrieved 2007-07-10.

- ^ Ken Belsen and Matthew L. Wald, " '03 Blackout Is Recalled, Amid Lessons Learned", New York Times, August 13, 2008, found at NY Times website. Retrieved August 27, 2008.

- ^ David Freedlander, "It could happen again: On fifth anniversary of blackout, nation still vulnerable", A.M. N.Y., August 12, 2008. See response at Letter to the Editor. Retrieved August 27, 2008.

- ^ Report, Energy and Commerce Committee, "Blackout 2003: How Did It Happen and Why? Full Committee on Energy and Commerce, September 4, 2003, found at Energy and Commerce Committee website. Retrieved August 27, 2008. Archived November 25, 2008, at the Wayback Machine

- ^ Knight, Peyton. "Small Group of House Republicans Derails ANWR Drilling Archived 2014-08-03 at the Wayback Machine." Washington, DC: The National Center for Public Policy Research. November 10, 2005.

- ^ Pub.L. 110-140, 121 Stat. 1492.

- ^ Summary of the Energy Independence and Security Act of 2007, "New Energy Law Raises CAFE Standards," December 19, 2007, found at Environment BLR website. Retrieved February 17, 2009.

- ^ ("2007 Farm Bill"), Pub.L. 110-234, 122 Stat. 923 Pub. L. 110–234 (text) (PDF).

- ^ Wall Street Journal article from Google News. Retrieved August 12, 2008.

- ^ David Cho, "Sway of oil speculators revealed", Washington Post, August 21, 2008, synidated at the Albany Times Union, found at Albany Times Union website. Retrieved August 27, 2008. Archived October 14, 2008, at the Wayback Machine

- ^ "Obama vows crackdown on energy speculators: McCain fires back after Democrat tries to tie rival to 'Enron loophole'". Associated Press. 2008-06-22. Retrieved 2008-07-24.

- ^ Sandler, Michael, "Dems get ready to rule," The Hill, found at TheHill website. Retrieved October 29, 2008.

- ^ "Chu to be Energy Secretary". change.gov. 2008-12-15. Archived from the original on 2014-08-13. Retrieved 2008-12-16.

- ^ New York Times interview with Steven Chu. Retrieved April 20, 2009.

- ^ a b AP, "Feds propose big cut in restricted area at Hanford," March 29, 2009, found at Seattle Post Intelligencer website[dead link]. Retrieved March 30, 2009.

- ^ Matthew L. Wald, "Energy Dept. Aid for Scientists on the Edge," New York Times, October 25, 2009, found at NY Times article. Retrieved October 26, 2009.

- ^ I.R.C. § 48; rules published at Internal Revenue Bulletin 2008-34. Dated August 25, 2008. Accessed April 11, 2013.

- ^ Internal Revenue Service, 1040 Instructions, Form 1040 line 52, instructions pages 5, 45, and Form 5695. Instruction for Form 1040 Found online at [1], and for Form 5695 at [2]. Both accessed April 11, 2013.

- ^ Internal Revenue Service, Energy Incentives for Individuals in the American Recovery and Reinvestment Act, found at [3]. Updated November 4, 2011. Accessed April 11, 2013.

- ^ ARRA, the American Recovery and Reinvestment Act of 2009, Pub. L. 111–5 (text) (PDF), see GPO website; H.R. 1, see H.R. 111-1 at the Library of Congress Archived 2014-10-04 at the Wayback Machine. Retrieved March 23, 2009.

- ^ Traci Watson, "Consumers Could Foil Plans for Conservation: People buy energy efficient items, then use them more," USA Today, March 23, 2009, found at iStockAnalyst website Archived 2012-02-13 at the Wayback Machine, original found at USA Today website. Retrieved March 23, 2009.

- ^ Analysis of ARRA at the Department of Energy website. Retrieved March 23, 2009.

- ^ "SUMMARY: AMERICAN RECOVERY AND REINVESTMENT" (PDF). Committee on Appropriations. 2009-02-13. Archived from the original (PDF) on February 16, 2009. Retrieved 2009-02-17.

- ^ "Recovery.gov website". Archived from the original on 2009-09-17. Retrieved 2009-09-17.

- ^ "WTMW website". Archived from the original on 2012-02-17. Retrieved 2014-07-02.

- ^ Gas Hydrates on Alaska's North Slope Archived 2010-06-01 at the Wayback Machine.

- ^ "EIA State Energy Profiles: Alaska". 2008-06-12. Retrieved 2008-06-24.

- ^ Screening Report for Alaska Rural Energy Plan, April 2001 Archived February 16, 2008, at the Wayback Machine

- ^ CNN Money (2005). "How tax friendly is your state?" Retrieved from CNN website.

- ^ Department of Revenue Tax Division website

- ^ Alaska Permanent Fund website About the Fund page. Retrieved March 10, 2009. Archived April 22, 2009, at the Wayback Machine

- ^ Alaska Permanent Fund website Fund Law page. Retrieved March 10, 2009. Archived September 24, 2009, at the Wayback Machine

- ^ Alaska Constitution Article IX, Section 15, found at Alaska Permanent Fund website Alaska constitution and law pertaining to the Permanent Fund. Retrieved March 10, 2009. Archived April 15, 2009, at the Wayback Machine

- ^ Alaska Statutes § 37.13.120. "Investment responsibilities," found at Alaska Permanent Fund website Alaska state law concerning Fund investments. Retrieved March 10, 2009. Archived September 24, 2009, at the Wayback Machine

- ^ Alaska Statutes § 37.13.140. "Income." and § 37.13.145. "Disposition of income." found at Alaska state law concerning Fund income. Retrieved March 10, 2009. Archived May 24, 2009, at the Wayback Machine

- ^ "Alaska Administrative Code (AAC) pertaining to the Permanent Fund," 15 AAC Chapter 137. "Revenue Receipt, custody, investment and management of state funds," found at Alaska Permanent Fund website. Retrieved March 10, 2009. Archived May 24, 2009, at the Wayback Machine

- ^ a b "Across the USA: Alaska:Fairbanks," USA Today, November 13, 2009, p. 13A.

- ^ a b Alaska Natural Gas Transportation Projects government website biography of Drue Pearce Archived 2010-08-08 at the Wayback Machine. Retrieved August 6, 2010.

- ^ Alaska Natural Gas Transportation Projects government website biography of Larry Persily Archived June 20, 2013, at the Wayback Machine. Retrieved August 6, 2010.

- ^ See Official code and BSC website.

- ^ Energy Conservation and Management Division website main page. Retrieved February 19, 2009.

- ^ Energy, Minerals and Natural Resources Department website. Retrieved February 19, 2009.

- ^ a b c Energy Conservation and Management Division website page on Laws, Regulations, Executive Orders. Retrieved February 19, 2009.

- ^ See, e.g., Brookins, Douglas G. (1977) Uranium deposits of the Grants mineral belt: geochemical constraints on origin, in Exploration Frontiers of the Central and Southern Rockies, Denver: Rocky Mountain Association of Geologists, p. 337–52; Granger, H.C. et al., "Sandstone-type uranium deposits at Ambrosia Lake, New Mexico-an interim report," Economic Geology, Nov. 1961, pp. 1179–1210.

- ^ "Atomic Energy: Uranium Jackpot". Time. 1957-09-30. Archived from the original on October 19, 2011. Retrieved July 1, 2013.(lists many companies)

- ^ McLemore, V. (2007). "URANIUM RESOURCES IN NEW MEXICO" (PDF). New Mexico. Retrieved July 1, 2013.

- ^ Energy Legal Blog Archived 2008-05-16 at the Wayback Machine, citing House bill 0188 session 2007 about New Mexico Renewable Energy Transmission Authority and Senate bill 0418 session 2007 about renewable portfolio standards. Retrieved February 17, 2009.

- ^ a b Kelly de la Torre & Julia Jones, Memorandum of Law, "Update: President-elect Barack Obama's Renewable Energy Policy and New Mexico," (n.d., December 2008?), found at Beatty & Wozniak P.C. Law firm website Archived 2012-11-27 at the Wayback Machine. Retrieved February 17, 2009.

- ^ "Energy team add UNM professor", Daily Lobo, November 17, 2003, Daily Lobo archives. Retrieved February 17, 2009. Archived June 4, 2009, at the Wayback Machine

- ^ FERC government website Biography of Commissioner Kelly web page. Retrieved February 17, 2009. Archived August 25, 2009, at the Wayback Machine

- ^ Bhambhani, Dipka (September 22, 2009). "FERC Commissioner Kelly Won't Seek 3rd Term". Clean Skies. Archived from the original on April 18, 2013. Retrieved November 14, 2012.

- ^ "District court puts brakes on N.M. energy law," Contractor Magazine, December 1, 2008 (Penton Media), found at Contractor Magazine website. Retrieved February 17, 2009.

- ^ AP, "Taos passes strict new building code," March 2, 2009, found at AP report on KRQE-TV website Archived 2013-04-05 at the Wayback Machine. See also "Taos passes strict new building code," found at MSNBC website. Retrieved March 4, 2009.

- ^ "Town of Taos Updates," Taos Daily & Horse Faly, October 31, 2008, found at Taos Daily website. Retrieved March 4, 2009.

- ^ "Highlights from the Town of Taos special Council meeting of 10/28/08," found at galleryrealtyoftaos.com website. Retrieved March 4, 2009.

- ^ "Highlights from the Town of Taos special Council meeting of 2/19/09," found at galleryrealtyoftaos.com website. Retrieved March 4, 2009.

- ^ Energy Star Home Rebate form, see New Mexico Gas Company website Energy Star Home Rebate form. Retrieved March 4, 2009.

- ^ "Across the USA News from every state," USA Today, October 28, 2009, p. 7A, found at USA Today archives. Retrieved October 28, 2009.

- ^ "Richardson Announces $8.1 Million in Stimulus Funds," Gila Sustainable Community News, Calendar and Forum, October 28, 2009, found at Gila Community News website with complete list of all 21 projects. Retrieved October 28, 2009.

- ^ N.Y. Energy Law § 1-101, found at New York State Legislature official web site, go to "ENG", then "Article 1", finally "1-101 - Short title". Retrieved August 6, 2008.

- ^ N.Y. Energy Law § 1-103 (5) and (6), found at New York State Legislature official website, go to "ENG", then "Article 1", finally "1-103 – Definitions". Retrieved August 6, 2008.

- ^ N.Y. Energy Law § 1-103 (4), found at New York State Legislature official website, go to "ENG", then "Article 1", finally "1-103 - Definitions". Retrieved August 6, 2008.

- ^ a b NYSERDA official website About webpage Archived 2012-12-14 at archive.today. Retrieved August 6, 2008.

- ^ NYSERDA official website Board of Directors webpage. Retrieved August 6, 2008.

- ^ NYSERDA official website Chairman's webpage[permanent dead link]. Retrieved August 6, 2008.

- ^ N.Y. Public Authorities Law §§ 1850 et seq., found at New York State Legislature official website, go to "PBA", then "Article 8", finally "Title 9 – (1850–1883) NEW YORK STATE ENERGY RESEARCH AND DEVELOPMENT AUTHORITY". Retrieved August 6, 2008.

- ^ NYSERDA law from its official website[permanent dead link] (pdf document). Retrieved August 6, 2008.

- ^ Anschutz Exploration Corp. v. Town of Dryden __ N.Y.S.2d ___ (Index # 2012-0902) (N.Y. Supreme Ct. Tompkins Co. February 21, 2012), and Cooperstown Holstein Corp. v. Town of Middletown, __ N.Y.S.2d ___ (Index # 2012-0930) (N.Y. Supreme Ct. Otsego Co. February 24, 2012). For discussion of these cases, see Charles Gottlieb, Hydrofracking, Local Zoning, and State Preemption, paper presented at the Warren M. Anderson Legislative Breakfast Series, "Hydrofracking – Balancing the 3 E's: Energy, Environment, and Economic Development," February 28, 2012 (Albany Law School); Andrew Carden, "Judge rules local governments can ban fracking," Legislative Gazette, February 28, 2012, page 13; Andrew Carden, "Another victory for anti-frackers," Legislative Gazette, March 6, 2012, pp. 8, 19. Compare N.Y. Environmental Conservation Law § 23-0303 (2), found at N.Y. State assembly website. Retrieved February 29, 2012.

- ^ Mark Fass, "Panel Finds D.A. Can Prosecute Polluter Under N.Y. Law", New York Law Journal (N.Y.L.J.), August 22, 2008, may be found at Bloglines website[permanent dead link] or N.Y.L.J. website (Subscription Required). Citing People v. Quadrozzi, No. 2006-065575 (2d dep't 2008), which cited N.Y. ECL §§ 71-0403 and 71-1933 (9), see NY Laws at the Assembly official website, go to "ENV – Environmental Conservation", then "ARTICLE 71 – ENFORCEMENT". Links accessed August 27, 2008. [dead link]

- ^ website of Member of Assembly Sandy Galef Archived 2012-12-01 at the Wayback Machine. Retrieved August 27, 2008.

- ^ Texas Railroad Commission official website. Retrieved August 21, 2008.

- ^ a b About the RRC Web page, on the Texas Railroad Commission official website. Retrieved August 21, 2008. Archived August 2, 2008, at the Wayback Machine

- ^ Krancer, Michael (September 30, 2016). "If there were a big 12 of energy the University of Houston would be a star". Forbes. Retrieved October 4, 2014.

- ^ ACT 250: A Guide to Vermont's Land Use Law. State of Vermont Environmental Board, Montpelier, VT (USA), November 2000 Archived 2013-05-21 at the Wayback Machine. Retrieved February 19, 2009.

- ^ a b Press release, "UW Energy Research Diversifies", July 17, 2008, found at University of Wyoming official website. Retrieved August 21, 2008.

- ^ Wyoming Oil and Gas Conservation Commission official website. Retrieved August 21, 2008.

- ^ Wyoming Natural Gas Fair Association official website. Retrieved August 21, 2008.

- ^ Press release, "School of Energy Resources Symposium Will Explore Coal Gasification in Wyoming", February 14, 2007, found at University of Wyoming official website. Retrieved August 21, 2008.

- ^ Symposium agenda, "Coal Gasification: What Does It Mean for Wyoming?" found at Western Research of the University of Wyoming official website Archived 2012-02-16 at the Wayback Machine. Retrieved August 21, 2008.

- ^ Walters, Jonathan (October 2013). "The Politics Behind Not Levying Personal Income Taxes: In the nine states that don't levy a personal income tax, the politics of staying that course remains powerful". Governing. Retrieved October 31, 2013.

- ^ Paul Davidson, "Nuclear power inches back into energy spotlight," USA Today, March 30, 2009, at B1, found at USA Today story of March 30, 2009. Retrieved March 30, 2009.

- ^ Rick Callahan, "Governor signs coal-gasification bill," Associated Press (as published in the Chicago Tribune), March 24, 2009, found at Chicago Tribune website. Retrieved March 25, 2009.

- ^ Matt Viser, "Patrick touts clean energy, economic initiatives, Boston Globe, August 5, 2008 found at Boston Globe website. Retrieved August 21, 2008.

- ^ a b AP, "UNH student research leads to new wind energy law", Boston Globe, July 23, 2008, found at Boston Globe article on new New Hampshire energy law. Retrieved August 21, 2008. [dead link]

- ^ AEP Ohio Meets Goal of New Ohio Energy Law by Filing Electric Security Plan Below Market Rates; Continues Lowest Rates in the State; Balanced and progressive plan demonstrates "AEP's Commitment to Ohio's Future", found at Market Watch website[permanent dead link]. Retrieved August 21, 2008.

Further reading

[edit]- Official website of the White House on energy