Masayoshi Son

This article may be unbalanced toward certain viewpoints. (April 2024) |

Masayoshi Son | |

|---|---|

孫 正義 | |

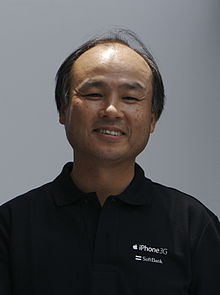

Son in 2008 | |

| Born | Masayoshi Yasumoto (安本 正義)[1] 11 August 1957 Tosu, Saga, Japan |

| Alma mater | University of California, Berkeley |

| Occupation(s) | Entrepreneur, investor, philanthropist |

| Known for | Principal founder of Softbank |

| Title | Chairman and CEO, SoftBank |

| Spouse | Masami Ohno |

| Children | 2 |

Masayoshi Son (Japanese: 孫 正義, romanized: Son Masayoshi, Korean: 손정의, romanized: Son Jeong-ui; born 11 August 1957) is a Japanese billionaire technology entrepreneur, investor and philanthropist. A third-generation Zainichi Korean, he naturalized as a Japanese citizen in 1990.[2] He is the founder, representative director, corporate officer, chairman and CEO of SoftBank Group Corp. (SBG),[3] a strategic technology-focused investment holding company, as well as chairman of UK-based Arm Holdings.[4]

As an entrepreneur, he achieved notability in PC software distribution, computing-related book and magazine publishing, and telecommunications in Japan, starting in the 1980s and booming throughout the 1990s and 2000s.[5][6] Poor investment decisions of Masayoshi Son's SoftBank Group led to a panoply of losing[7] investments across the history of the company.[8][9][10][11] Since Son founded SoftBank in 1981, he has made many investments, but the vast majority of those deals failed, and his reputation as an investor rests almost solely on his $20 million initial investment in Alibaba Group in 2000, a stake that had grown to a paper valuation of about $50 billion[12] just before the Alibaba IPO[13] in 2014.[14] SoftBank's 27 percent stake in Alibaba was worth $132 billion[15] in 2018, including additional purchases of the stock since 2000.[16][17] The morphing of his own telecom company SoftBank Corp. into an investment management firm called SoftBank Group Corp. made him noted worldwide as a stock investor. However, after a number of high-profile setbacks, Son's investing strategy in the first and second SoftBank Vision Funds established in 2017 and 2019, has been described as one reliant on the greater fool theory.[18] A controversial figure,[19][20][21] Son has been called a gambler,[22] mocked by some specialized media[23] and dubbed the worst investor ever,[24][25] being known for eccentricity[26] and criticized because of his hubris.[27][28]

In 2013, Son was placed 45th on the Forbes magazine's list of the World's Most Powerful People.[29] In the 2018's ranking, he was placed on the 55th position.[30]

As of July 2024, Son ranks 49th[31] on the Forbes's list of The World's Billionaires and is #110[32] on the Bloomberg Billionaires Index. He had for many years the distinction of being the person who had lost the most money in history (more than $59bn[33] during the dot com crash of 2000 alone, when his SoftBank shares plummeted),[34] a feat surpassed by Elon Musk[35][36][37] in the following decades.

Early life and education

[edit]Masayoshi Son was born as the second of four sons in Tosu (鳥栖市, Tosu-shi), a city in the eastern part of Saga Prefecture on the island of Kyushu, Japan.[2][38][39][40]

Son is a 3rd generation Zainichi Korean. Zainichi Koreans are ethnic Koreans with permanent residency or citizenship in Japan.[41] Son's grandfather, Son Jong-kyung, moved from Daegu to Japan during the Japanese colonial period, where he worked as a miner.[2] His father is Son Sam-heon.

His father and other Koreans illegally built their houses on land that was owned by Japan National Railways, which caused them trouble with the authorities.[42] His father raised pigs and chickens on that land, and started an illegal sake business that eventually became successful enough for his family to become the first people in town to own a car.[42] His family eventually moved out of the neighborhood so that Son could attend a better school.[42]

Son pursued his interests in business by securing a meeting with Japan McDonald's president Den Fujita. Taking his advice, Son began studying English and computer science.[43]

He left to study in the U.S. on Fujita's advice.[2] At age 16, Son moved from Japan to California and lived with his friends and family in South San Francisco. He finished high school in three weeks by taking the required exams at Serramonte High.[44]

Son attended the University of California, Berkeley where he studied economics and computer science majoring in economics.[45][46] At age 19, Son became confident that computer technology would ignite the next commercial revolution after being impressed by a microchip featured in a magazine.[47]

He began his first business endeavours while still a student. With the help of some professors, Son created an electronic translator that he sold to Sharp Corporation for $1.7 million. He made another $1.5 million by importing used video game machines from Japan, on credit and installing them in dormitories and restaurants.[39]

Son graduated from Berkeley with a B.A. in Economics in 1980,[48] and started a video game company called Unison World in Oakland, CA. He later sold the company to an associate for close to $2 million, and the company was eventually acquired by Kyocera.[49]

Son used his family's adopted Japanese surname for much of his childhood.[39] However, after he returned to Japan, Son decided to use his family's original Korean surname[50][42] instead. For this action and other similar ones, Son is considered to be a role model for ethnic Korean children in Japan.[51]

SoftBank

[edit]Masayoshi Son is the founder, CEO and largest shareholder of SoftBank; as of December 2022, he had a 34.2% stake in the company.[52]

SoftBank Corp.

[edit]Masayoshi Son was the founder of SoftBank Corp. In 1981, it operated as a software vendor, becoming a major telecommunications operator in Japan and later morphing into SoftBank Group Corp., an investment holding company. SoftBank Corp., the telecom, remained in business as a spun out company of SoftBank Group Corp, the investment firm.[53] To reflect this, the company name of SoftBank Corp. was changed to SoftBank Group Corp., and the company name of SoftBank Mobile Corp. was changed to SoftBank Corp. in 2015.

However, even before the establishment of SoftBank Group Corp. as an entity devoted to investing in other companies, SoftBank Corp. as a telecom was regularly used by Son as an investment vehicle which experienced both successes (as in the case of Alibaba in 1999 and Yahoo! in 1995) and failures (such as an investment in Kingston Technology, during which SoftBank bought 80% of the shares in 1996 but then sold the company back in 1999 at a loss to the original owners for a third of the original price).[54]

In 2021, Masayoshi Son relinquished his position as CEO of SoftBank Mobile, the mobile business of SoftBank Corp.[55]

Yahoo! and Alibaba

[edit]

Son was an early investor in internet firms, buying a share of Yahoo! in 1995 and investing a $20 million stake into Alibaba in 1999; he was briefly the richest person in the world before the stock market crashed.[56] Son's holding company SoftBank owned 29.5% of Alibaba, which was worth around $108.7 billion as of 23 October 2018.[57][58][59] Although SoftBank's stake in Yahoo! had dwindled to 7%, Son established Yahoo! BroadBand in September 2001 with Yahoo! Japan in which he still owned a controlling interest. After a severe devaluation of SoftBank's equity, Son was forced to focus his attention on Yahoo! BB and BB Phone. So far, SoftBank has accumulated about $1.3 billion in debt. Yet, Yahoo! BB acquired Japan Telecom, the then third largest broadband and landline provider with 600,000 residential and 170,000 commercial subscribers. Yahoo! BB is now Japan's leading broadband provider.[citation needed] In June 2020, Son stepped down from the Alibaba board.[60] By 2023, SoftBank had sold most of its Alibaba stake.[61]

Arm Holdings

[edit]In July 2016, SoftBank announced plans to acquire Arm Holdings for £23.4 billion ($31.4 billion) which would be the largest ever purchase of a European technology company. In September 2016, SoftBank announced that the transaction was complete. The total acquisition price was approximately £24 billion ($34 billion).[62][57]

In 2020, SoftBank Group agreed to sell U.K. chip designer Arm Limited to U.S. chip-maker Nvidia in a cash and stock deal initially worth $40 billion. The buy price, initially set at $40bn (cash and Nvidia shares) when first announced in September 2020, had risen closer to an estimated $66bn by 2022 given the intervening hike in Nvidia's stock – that would make this deal the biggest deal in the semiconductor market. Announcing the deal, SoftBank said the combination of Arm and Nvidia would create a computing company "that will lead the era" of artificial intelligence.[63] However, the deal with Nvidia failed as announced in February 2022.[64][65] After the collapse of the deal with Nvidia because of objections from U.S. and E.U. antitrust regulators, SoftBank Group Corp's chip maker Arm filed in 2023 with regulators confidentially for a U.S. stock market listing seeking to raise between $8 billion and $10 billion.[66] The estimated value of the UK chipmaker being listed by SoftBank at that date ranged from $30bn to $70bn.[67]

Sprint Corporation

[edit]In the 2010s, through his holdings in SoftBank, Son bought a 76% share in Sprint. SoftBank later accumulated further shares in Sprint to about 84% ownership.[68][69]

Sprint and T-Mobile US merged in 2020 in an all shares deal for $26 billion. By 2021, SoftBank Group Corp. had acquired 4.5% of Deutsche Telekom AG (parent company of T-Mobile) and sold its stake in T-Mobile US Inc. to the German telecommunications carrier.[70]

Solar power

[edit]In response to the Fukushima Daiichi nuclear disaster in 2011, Masayoshi Son criticized the nuclear industry for creating "the problem that worries Japanese the most today"[71] and engaged in investing in a nationwide solar power network for Japan.[72] In March 2018, it was announced that Son was investing in the biggest ever solar project, a 200GW development planned for Saudi Arabia as part of its Vision 2030.[73]

In July 2018, coverage indicated that Son "would underwrite most of 100 GW" of a planned 275 GW of new renewable provision in India by 2027.[74]

Vision Fund

[edit]Established in 2017, SoftBank Group's investment vehicle, the $100 billion Vision Fund, was intended to invest in emerging technologies like artificial intelligence (AI), robotics and the internet of things.[75] As of 2019, it aimed to nearly double its portfolio of AI companies from 70 to 125.[76] However, it also invested in companies supposedly focused on revolutionizing real estate, transportation, and retail. Son claimed he would make personal connections with the CEOs of all companies funded by Vision Fund in order to enhance the creation of intertwined synergies among those companies.[77][78] Son planned to raise $100 billion for a new fund every few years, investing about $50 billion a year in startups.[40] In 2019, a second Vision Fund was created with a target of $108 billion, of which $38 billion would come from Softbank itself.[79] But the amount was scaled down due to lack of investing partners beyond Softbank Group itself and Masayoshi Son.[80][81]

As of 2020, the first fund had invested in 88 companies including Coupang,[83] Didi,[84] Doordash,[85] Fanatics,[86] Grab,[87] Oyo,[88] Paytm[89] Uber,[90] and WeWork,[91] but had experienced an awkward fall from grace[92][93][94][95] as the COVID-19 pandemic and a Chinese regulatory crackdown[96][97] accelerated the exposure of the Japanese investment management conglomerate's portfolio weaknesses.[98] Son became noted as a stock investor after the meteoric rise of Alibaba Group. He had invested $20 million in Jack Ma's Alibaba back in 2000 when it was a young Chinese startup company[99] although regrettably passing up early opportunities to invest in both Amazon and Tesla.[100] In addition, he raised his global profile as stock investor since starting Softbank Vision Fund in 2017, creating an unprecedented investment vehicle of almost $100 billion to back technology startups. But by 2021, he was still struggling to persuade investors of the value of his efforts, in part because of fiascoes and troublesome losses with companies such as WeWork, OneWeb, Wirecard,[101] OYO Rooms, Katerra[102] or Greensill Capital, and SoftBank Group's own stock chronically traded far below the value of its assets reflecting a discount[103] associated to tax liabilities, risk, past performance, losses, performance fees and high probability of occurrence of several haircuts given Son's poor track record while running the Vision Fund[104] and high enthusiasm for investing vast sums in loss-making companies at eye-popping valuations.[105][106][107][108][109] By October 2021, Masayoshi Son had accelerated the pace of his startup investments quintupling the number of companies in his Vision Fund 2 portfolio in less than 9 months, SoftBank was cutting more deals with fewer staff than ever and the average investment amount per company had fallen from $943 million in Vision Fund 1 to $192 million in Vision Fund 2.[110][111][112] In 2022, SoftBank Vision Fund posted a record 3.5 trillion yen loss ($27.4 billion) for its financial year ended on 31 March 2022 as the valuation of its stock portfolio plummeted.[113] SoftBank's bad timing-prone, impulsive investment decisions regarding previously overhyped and consequently overvalued startups like Klarna,[114][115] had plunged in value while some other investment firms had even been able to cash in before the startups' comedown to reap hundreds of millions of dollars in profit.[116] In August 2022, Masayoshi Son said he was "embarrassed" and "ashamed" when asked to talk about the way he had run the SoftBank Vision Fund[117][118] and Barron's characterized the fund as a "failed experiment"[119] while The Wall Street Journal called SoftBank a "big loser"[56] and Bloomberg elaborated on "Masayoshi Son's broken business model".[120]

By November 2022, according to the Financial Times, Masayoshi Son personally owed SoftBank $4.7bn because of growing losses on the Japanese conglomerate's technology bets, which have also rendered the value of his stake in the group's second Vision Fund worthless.[121] By February 2023, this personal debt totaled $5.1 billion according to Bloomberg calculations based on company disclosures. This debt on side deals he set up at SoftBank Group Corp. to boost his compensation, as losses mounted at its core Vision Fund venture capital arm, sparked controversy due to corporate governance concerns, but Son insisted that there wasn't any conflict of interest.[122] As of March 2023, while the collapse of Silicon Valley Bank was being investigated,[123] over a third of Son's SoftBank shares had been reportedly posted as collateral for margin loans and the Financial Times were recalling signs of an emergent doomsday scenario for both SoftBank Group and Masayoshi Son.[124]

Personal life

[edit]Son met his wife, Masami Ohno, the daughter of a prominent Japanese doctor, while both were students at the University of California, Berkeley.[125] They got married in 1979 and have two daughters.[126] He lives in Tokyo in a three-story mansion that is valued at $50 million and that has a golf range with technology to mimic the weather conditions and temperature of the world's top golf courses. He has also bought a home near Silicon Valley in Woodside, California, that cost him $117 million. He owns the SoftBank Hawks, a professional Japanese baseball team.[127] Son has three brothers and is the second oldest of the siblings. His youngest brother, Taizo Son, is a serial entrepreneur and investor, having founded GungHo Online Entertainment and the venture capital firm Mistletoe.[128]

When he went to the United States at 16 to attend high school and then the University of California Berkeley, he decided to use his real Korean surname.[50][42] "If I had stayed all the time in Japan, Mr. Son said, I probably would have become much more conservative, just as other Japanese."[42]

See also

[edit]References

[edit]- ^ "SoftBank's Son stands up to anti-Korean bigotry in Japan". Nikkei Asia. 27 August 2015.

- ^ a b c d "[인물 프로필] 거지소년 손정의(孫正義) 재일교포 일본서 돈 번 비결, 소프트뱅크 세계 최대 IT 재벌 인생 스토리" [[Person Profile] Son Jeong-ui]. 글로벌이코노믹 (in Korean). 4 July 2019. Retrieved 2 May 2021.

- ^ Ltd, Arm. "Board of Directors". Arm | The Architecture for the Digital World. Retrieved 24 March 2023.

- ^ "Masayoshi Son's $58 Billion Payday on Alibaba". Bloomberg.com. 8 May 2014. Archived from the original on 12 June 2018. Retrieved 11 December 2017.

- ^ Webber, Alan M. (1 January 1992). "Japanese-Style Entrepreneurship: An Interview with Softbank'S CEO, Masayoshi Son". Harvard Business Review. ISSN 0017-8012. Retrieved 10 June 2023.

- ^ "SoftBank's Masayoshi Son won iPhone exclusivity after pitching Apple cellphone to Steve Jobs". AppleInsider. 13 March 2014. Retrieved 10 June 2023.

- ^ Chadha, Amrit (4 August 2020). "Lost Vision: The Many Failures of Masayoshi Son". The Pangean. Retrieved 7 June 2023.

- ^ "SoftBank's Top 10 Worst Startup Investments - ValueWalk". www.valuewalk.com. 10 March 2020. Retrieved 20 April 2023.

- ^ 'Too much guts, sometimes I lose a lot of money', SoftBank's Masayoshi Son tells Alibaba's Jack Ma, 6 December 2019, retrieved 8 May 2023

- ^ "SoftBank Vision Fund Posts Record Loss Despite Masayoshi Son Foreseeing Disaster". Observer. 11 May 2023. Retrieved 13 May 2023.

- ^ "As SoftBank's Masayoshi Son jumps on the AI bandwagon, where will he take his chip business?". Yahoo Finance. 20 June 2023. Retrieved 21 June 2023.

- ^ "Alibaba IPO highlights SoftBank's value dilemma". Reuters. 22 September 2014. Retrieved 14 June 2023.

- ^ Pisani, Bob (27 August 2014). "Alibaba IPO likely happening late September". CNBC. Retrieved 6 May 2023.

- ^ "Alibaba IPO: Why List in the U.S.?". Investopedia. Retrieved 6 May 2023.

- ^ Merced, Michael J. de la (13 July 2018). "Investing in SoftBank Is Becoming a Bet on Its Founder's Deal-Making Prowess". The New York Times. ISSN 0362-4331. Retrieved 6 May 2023.

- ^ "Inside the eccentric, relentless deal making of SoftBank's Masayoshi Son". Los Angeles Times. 2 January 2018.

- ^ "Mega-IPO to rekindle the 'bromance' behind Alibaba's rise". CNBC. 27 August 2014. Retrieved 6 May 2023.

- ^ Williams, Oscar (11 August 2022). "The dangerous approach of SoftBank's Masayoshi Son". New Statesman. Retrieved 2 September 2022.

- ^ "Masayoshi Son: Inside the eccentric world of the controversial Japanese billionaire investor". The Independent. 15 January 2018. Retrieved 24 November 2022.

- ^ Mistry, Jigar (22 November 2022). "SoftBank: Fallacies of past performance; learnings from SoftBank". The Economic Times. Retrieved 24 November 2022.

- ^ "SoftBank blazes a trail in losing money on tech bets". Financial Times. 13 November 2022. Retrieved 20 December 2022.

- ^ Pollack, Andrew (19 February 1995). "A Japanese Gambler Hits the Jackpot With Softbank". The New York Times. ISSN 0362-4331. Retrieved 21 February 2023.

- ^ "Some suggested slides for SoftBank". Financial Times. 10 November 2022. Retrieved 11 November 2022.

- ^ "First Bitcoin, Now WeWork: Is Masayoshi Son the Worst Investor Ever?". CCN.com. 26 September 2019. Retrieved 11 October 2022.

- ^ "SoftBank's Woes: A Deep Dive". ARPU!. 24 May 2022. Retrieved 21 February 2023.

- ^ "Inside the Eccentric, Relentless Deal-Making of Masayoshi Son". Bloomberg.com. 2 January 2018. Retrieved 19 May 2023.

- ^ Schleifer, Theodore (6 December 2017). "SoftBank's Masayoshi Son is about to make either himself or you look like a fool". Vox. Retrieved 19 May 2023.

- ^ Chowdhury, Hasan. "SoftBank's founder compared himself to Jesus and Yoda. His tech fund lost a record $32 billion this year". Business Insider. Retrieved 19 May 2023.

- ^ Caroline Howard. "No. 45: Masayoshi Son - In Photos: The World's Most Powerful People: 2013". Forbes. Archived from the original on 11 October 2017. Retrieved 4 September 2017.

- ^ "Masayoshi Son". Forbes. Retrieved 12 May 2023.

- ^ Forbes.com Retrieved 13 May 2022

- ^ "Bloomberg Billionaires Index". Bloomberg.com. 18 May 2023. Retrieved 19 May 2023.

- ^ "The biggest and fastest net-worth losses of our time". fortune.com. Retrieved 1 January 2023.

- ^ Sorkin, Andrew Ross (13 December 2010). "A Key Figure in the Future of Yahoo". The New York Times. Archived from the original on 21 May 2012. Retrieved 7 April 2012.

- ^ "Elon Musk becomes first person ever to lose $200 billion". 1 January 2023. Retrieved 1 January 2023.

- ^ "Elon Musk breaks world record for 'worst loss of fortune,' Guinness says". Washington Post. ISSN 0190-8286. Retrieved 12 January 2023.

- ^ "How Elon Musk, Mark Zuckerberg and the World's 500 Richest Billionaires Lost $1.4 Trillion in a Year". Bloomberg.com. 29 December 2022. Retrieved 12 February 2023.

- ^ Pham, Sherisse (7 December 2016). "SoftBank founder Masayoshi Son: A 'crazy' billionaire obsessed with the future". Archived from the original on 27 September 2017. Retrieved 20 September 2017.

- ^ a b c Andrew Pollack (19 February 1995). "A Japanese Gambler Hits the Jackpot With Softbank". The New York Times. ISSN 0362-4331. Archived from the original on 25 February 2018. Retrieved 10 December 2017.

- ^ a b Martin, Alex (7 February 2019). "Masayoshi Son: Betting big and winning". Japan Times Online. Archived from the original on 23 February 2019. Retrieved 23 February 2019.

- ^ "不遇の環境を乗り越え、世界的実業家へ 孫正義の成功までの道のり". Forbes Japan (in Japanese). 15 March 2020. Archived from the original on 15 March 2020. Retrieved 23 May 2020.

- ^ a b c d e f Wudunn, Sheryl (26 July 1999). "MEDIA; an Entrepreneurial Exception Rides the Internet in Japan". The New York Times.

- ^ "The David Rubenstein Show: Masayoshi Son". Bloomberg. 11 October 2017. Archived from the original on 22 October 2017. Retrieved 21 October 2017.

- ^ Inoue, Atsuo (2013). "2: Grade Skipping". Aiming High: A Biography of Masayoshi Son. YouTeacher.

- ^ "Masayoshi Son: SoftBank's unicorn hunter". CNNMoney. Retrieved 12 May 2023.

- ^ "Masayoshi Son: 9 things you didn't know about one of Japan's richest CEOs". 18 April 2023. Retrieved 20 May 2023.

- ^ "Everything under the Son". The Economist. ISSN 0013-0613. Retrieved 20 May 2023.

- ^ "Masayoshi Son". Business week. Archived from the original on 10 April 2013. Retrieved 27 March 2013.

- ^ Webber, Alan (1 January 1992). "Japanese-Style Entrepreneurship: An Interview with Softbank'S CEO, Masayoshi Son". Harvard Business Review. Retrieved 25 August 2022.

- ^ a b "Son also rises". The Economist.

- ^ "CEO revealed Korean roots to inspire youths facing bigotry in Japan". Nikkei Asian Review. Archived from the original on 7 April 2018. Retrieved 21 March 2017.

- ^ Lee, Ming Jeong; Hyuga, Takahiko; Mak, Pei Yi (8 December 2022). "SoftBank's Masayoshi Son quietly lifts stake to 34%, edging toward buyout". The Japan Times. Retrieved 21 February 2023.

- ^ "SoftBank Group History". SoftBank Group Corp. Retrieved 24 March 2023.

- ^ Huffstutter, P. j; Gaw, Jonathan (15 July 1999). "2 Founders to Buy Back Kingston Stake From Softbank". Los Angeles Times. Retrieved 24 March 2023.

- ^ Majithia, Kavit (26 January 2021). "SoftBank names new mobile chief as Son steps back". Mobile World Live. Retrieved 24 March 2023.

- ^ a b Brown, Eliot (2 August 2022). "SoftBank Emerges as a Big Loser of the Tech Downturn. Again". Wall Street Journal. ISSN 0099-9660.

- ^ a b "Masayoshi Son goes on a $100bn shopping spree". The Economist. 30 March 2017. Archived from the original on 11 December 2017. Retrieved 11 December 2017.

- ^ Sender, Henny; Ling, Connie (18 January 2000). "Softbank to Invest $20 Million In Hong Kong's Alibaba.com". Wall Street Journal. ISSN 0099-9660. Archived from the original on 22 January 2018. Retrieved 11 December 2017.

- ^ Pfanner, Eric (19 September 2014). "SoftBank's Alibaba Alchemy: How to Turn $20 Million Into $50 Billion". WSJ. Archived from the original on 12 December 2017. Retrieved 11 December 2017.

- ^ "SoftBank's Masayoshi Son steps down from Alibaba board, defends his investing decisions". CNBC. 25 June 2020. Archived from the original on 11 July 2020. Retrieved 9 July 2020.

- ^ Inagaki, Kana; McMorrow, Ryan; Olcott, Eleanor (13 April 2023). "SoftBank moves to sell down most of its Alibaba stake". Financial Times. Retrieved 31 May 2023.

- ^ "SoftBank completes $31 billion acquisition of ARM". The Verge. Archived from the original on 29 December 2017. Retrieved 11 December 2017.

- ^ "SoftBank reaches $40bn deal to sell Arm to US chipmaker Nvidia". Nikkei Asia. Retrieved 22 June 2021.

- ^ Toh, Michelle (8 February 2022). "The biggest chip deal in history has fallen apart | CNN Business". CNN.

- ^ "Nvidia Abandons $66 Billion Acquisition of Arm - News". www.allaboutcircuits.com. Retrieved 8 January 2023.

- ^ Sen, Anirban; Wang, Echo (29 April 2023). "SoftBank's Arm registers for blockbuster U.S. IPO". Reuters. Retrieved 13 May 2023.

- ^ "High IPO valuation for Arm would be a warning to investors". Financial Times. 2 May 2023. Retrieved 13 May 2023.

- ^ "U.S. Securities and Exchange Commission - Homepage". sec.gov. Archived from the original on 24 February 2011. Retrieved 18 July 2020.

- ^ "SoftBank is in Big Trouble if Sprint T-Mobile Merger Doesn't Happen". wccftech.com. 6 May 2019. Archived from the original on 3 June 2019. Retrieved 3 June 2019.

- ^ "Deutsche Telekom moves to take control of T-Mobile with deal for SoftBank stake". Fortune. Retrieved 24 March 2023.

- ^ Penn, Michael (23 April 2011). "Masayoshi Son Castigates the Nuclear Industry". Shingetsu Blog. Archived from the original on 22 November 2011. Retrieved 31 August 2011.

- ^ Yasu, Mariko (23 June 2011). "Softbank's CEO Wants a Solar-Powered Japan". Bloomberg BusinessWeek. Archived from the original on 2 September 2011. Retrieved 23 August 2011.

- ^ Pham, Sherisse (28 March 2018). "SoftBank wants to build the world's biggest solar project in Saudi Arabia". CNNTech. Archived from the original on 28 March 2018. Retrieved 28 March 2018.

- ^ Buckley, Tim (3 July 2018). "IEEFA op-ed: India is helping bring the era of coal to an end". IEEFA.org. Archived from the original on 27 January 2020. Retrieved 27 January 2020.

- ^ "SoftBank's $100 Billion Vision Fund Is Run by These 10 Men". Bloomberg.com. 27 September 2018. Archived from the original on 16 January 2019. Retrieved 16 January 2019.

- ^ Brooker, Katrina (14 January 2019). "The most powerful person in Silicon Valley". Fast Company. Archived from the original on 16 January 2019. Retrieved 16 January 2019.

- ^ Sherman, Alex (1 August 2018). "Masayoshi Son building Vision Fund into family, say founders". www.cnbc.com. Archived from the original on 16 January 2019. Retrieved 16 January 2019.

- ^ "How SoftBank ate the world". Wired UK. ISSN 1357-0978. Retrieved 16 November 2022.

- ^ Klebnikov, Sergei. "SoftBank Launches Second Vision Fund With $2.5 Billion Investment: Report". Forbes. Archived from the original on 19 February 2020. Retrieved 19 February 2020.

- ^ Tan, Gillian; Turner, Giles (16 November 2019). "SoftBank's second Vision Fund is starting life a lot smaller than the first". www.business-standard.com.

- ^ Dash, Sanchita (18 May 2020). "SoftBank Vision Fund 2 fails to raise new funds — Masayoshi Son says the company will now use its own money for investments". Business Insider.

- ^ Bort, Julie. "WeWork has frittered away $46.7 billion in value as the stock sinks below 50 cents, one of the biggest startup failures of all time, and venture capitalists haven't learned a thing". Business Insider. Retrieved 31 May 2023.

- ^ "SoftBank-Backed Korean Unicorn Coupang Prepares for IPO as Soon as 2021". Bloomberg.com. 8 January 2020. Retrieved 29 December 2020.

- ^ "SoftBank leads $500 million fundraising for Didi's self-driving unit". Reuters. 29 May 2020. Retrieved 29 December 2020.

- ^ "SoftBank Soars on $11 Billion DoorDash Gain, Buyout Prospect". Bloomberg.com. 10 December 2020. Retrieved 29 December 2020.

- ^ Baker, Liana B. (6 September 2017). "Sports e-commerce firm Fanatics closes $1 billion funding round led by SoftBank". Reuters. Retrieved 29 December 2020.

- ^ Choudhury, Saheli Roy (6 March 2019). "Grab is now valued at $14 billion after landing $1.46 billion from SoftBank's Vision Fund". CNBC. Retrieved 29 December 2020.

- ^ "Masayoshi Son's Impatience Just Cost $17 Billion". Bloomberg.com. 13 April 2020. Retrieved 29 December 2020.

- ^ "Masayoshi Son". Forbes. Retrieved 22 July 2020.

- ^ "Uber's Biggest Investors". Investopedia.com. 16 April 2020. Retrieved 12 January 2021.

- ^ "SoftBank sees ¥700 billion loss from WeWork investment". 30 March 2020. Retrieved 6 September 2021.

- ^ "How Masayoshi Son's lack of vision is imperiling innovation". Nikkei Asia. Retrieved 16 November 2022.

- ^ "SoftBank's Son is losing his shine". Light Reading. Retrieved 16 November 2022.

- ^ "SoftBank's Masayoshi Son grilled by investors over governance lapses". Financial Times. 23 June 2021. Retrieved 16 November 2022.

- ^ "Hard truths about SoftBank". The Economist. ISSN 0013-0613. Retrieved 16 November 2022.

- ^ "With Alibaba stake cut, SoftBank's Son cools toward China tech". euronews. 12 August 2022. Retrieved 29 May 2023.

- ^ Kharpal, Arjun (30 August 2021). "China's regulatory crackdown has wiped billions off tech stocks — here are the risks ahead". CNBC. Retrieved 16 November 2022.

- ^ "SoftBank: is it game over?". Financial Times. 15 April 2020. Retrieved 16 November 2022.

- ^ Why Masayoshi Son Invested $20 Million in a Young Jack Ma, 11 October 2017, retrieved 16 November 2022

- ^ Meisenzahl, Mary. "Softbank CEO Masayoshi Son says he feels 'so stupid' for passing up early opportunities to invest in Tesla and Amazon". Markets Insider. Retrieved 16 November 2022.

- ^ "Wirecard forged client details to secure €900mn investment from SoftBank". Financial Times. 10 July 2022. Retrieved 16 November 2022.

- ^ "SoftBank-backed Katerra files for bankruptcy". Financial Times. 7 June 2021. Retrieved 16 November 2022.

- ^ Proud, Liam (6 February 2019). "SoftBank's C.E.O. Insists That the Company Is Undervalued. Is It?". The New York Times. ISSN 0362-4331. Retrieved 24 May 2023.

- ^ Dawkins, David. "SoftBank Founder Masayoshi Son 'Embarrassed' Over Investment Track Record". Forbes. Retrieved 16 November 2022.

- ^ "SoftBank Keeps Minting Billionaires Despite Massive Failures". Bloomberg.com. Retrieved 24 May 2023.

- ^ Elstrom, Peter (2 December 2019). "SoftBank's startup bookkeeping draws scrutiny after WeWork fiasco". The Japan Times. Retrieved 16 November 2022.

- ^ "Net Asset Value per Share". SoftBank Group Corp. Retrieved 16 November 2022.

- ^ Savitz, Eric J. "SoftBank Group Has Multiple Problems. It Also Has an Undervalued Stock". www.barrons.com. Retrieved 16 November 2022.

- ^ "Softbank Group shares slide 3% after Didi, Arm, Grab triple setback". Reuters. 3 December 2021. Retrieved 16 November 2022.

- ^ "'They are unrecognisable': Inside the 'new' SoftBank India of 2021". Moneycontrol. 13 December 2021. Retrieved 16 November 2022.

- ^ "SoftBank Is Cutting More Deals With Fewer Staff Than Ever (1)". news.bloomberglaw.com. Retrieved 16 November 2022.

- ^ Massoudi, Arash (10 June 2020). "SoftBank cuts 15% of jobs from Vision Fund arm". www.ft.com. Retrieved 24 June 2021.

- ^ Kharpal, Arjun (12 May 2022). "SoftBank Vision Fund posts record $27 billion loss as tech stocks plummet". CNBC. Retrieved 16 November 2022.

- ^ "Sequoia and Tiger Global Take SoftBank to the Cleaners". Bloomberg.com. 6 July 2022. Retrieved 30 May 2023.

- ^ Browne, Ryan (11 July 2022). "Klarna valuation plunges 85% to $6.7 billion as 'buy now, pay later' hype fades". CNBC. Retrieved 31 May 2023.

- ^ Dummett, Ben. "Klarna's Slashed Valuation Creates Losers and a Few Winners". WSJ. Retrieved 16 November 2022.

- ^ "SoftBank CEO 'ashamed' of pride in past profits as record losses prompt cost cuts". the Guardian. 8 August 2022. Retrieved 16 November 2022.

- ^ "SoftBank suffers as Son's bets on China tech backfire". Nikkei Asia. Retrieved 16 November 2022.

- ^ Savitz, Eric J. "The SoftBank Experiment Has Failed. Here's What Comes Next". www.barrons.com. Retrieved 16 November 2022.

- ^ "SoftBank's Epic Losses Reveal Masayoshi Son's Broken Business Model". Bloomberg.com. 23 August 2022. Retrieved 24 May 2023.

- ^ "Masayoshi Son owes $4.7bn to SoftBank following tech rout". Financial Times. 17 November 2022.

- ^ "Masayoshi Son Now Owes SoftBank $5.1 Billion on Side Deals". Bloomberg.com. 8 February 2023. Retrieved 12 February 2023.

- ^ "SVB Blowout May Drive SoftBank Shares Below Son's Pain Point, Trigger Buyback". Yahoo Finance. 15 March 2023. Retrieved 22 March 2023.

- ^ "Checking in on SoftBank". Financial Times. 20 March 2023. Retrieved 21 March 2023.

- ^ "Masayoshi Son, SoftBank's worried visionary". Financial Times. 22 May 2020. Retrieved 26 September 2022.

- ^ Sim, Walter (12 December 2016). "SoftBank's Masayoshi Son, the 'crazy guy who bet on the future". The Straits Times. Archived from the original on 13 November 2017. Retrieved 13 November 2017.

- ^ Parker, Garrett (7 September 2017). "10 Things You Didn't Know About Masayoshi Son". Archived from the original on 23 February 2019. Retrieved 23 February 2019.

- ^ Peterson, Jane A. (2 May 2018). "Serial Entrepreneur Taizo Son Finds A Welcoming Laboratory For His High-Tech Ideas". Forbes. Archived from the original on 23 February 2019. Retrieved 23 February 2019.

External links

[edit]- Masayoshi Son, AXA Talents, 1 August 2006, archived from the original on 18 June 2006.

- "Masayoshi Son: The CEO who lost $70bn in a day before conquering the world", Hot Topics, 2014, archived from the original on 26 March 2017, retrieved 21 November 2014

- 1957 births

- Baseball executives

- Businesspeople in telecommunications

- Japanese billionaires

- Japanese chief executives

- Japanese people of Korean descent

- Japanese sports businesspeople

- Living people

- 20th-century Japanese businesspeople

- 21st-century Japanese businesspeople

- People from Tosu, Saga

- SoftBank people

- Naturalized citizens of Japan

- Sprint Corporation

- UC Berkeley College of Engineering alumni

- Japanese chairpersons of corporations

- Japanese company founders

- Iljik Son clan

- Transhumanists

- Japanese inventors

- People named in the Pandora Papers

- Zainichi Korean businesspeople

- Inter Miami CF non-playing staff