Business cycle

This article's lead section may be too long. (March 2024) |

| Part of a series on |

| Macroeconomics |

|---|

|

| Часть серии о |

| Капитализм (За и против) |

|---|

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms. There are numerous specific definitions of what constitutes a business cycle. The simplest and most naïve characterization comes from regarding recessions as 2 consecutive quarters of negative GDP growth. More satisfactory classifications are provided by, first including more economic indicators and second by looking for more informative data patterns than the ad hoc 2 quarter definition.

Определения колебаний делового цикла во многом зависят от конкретного набора рассматриваемых макроэкономических переменных и особенностей методологии. В Соединенных Штатах Национальное бюро экономических исследований курирует Комитет по датировке деловых циклов, который определяет рецессию как «значительное снижение экономической активности, распространяющееся на рынок, продолжающееся более нескольких месяцев, обычно заметное по реальному ВВП , реальному доходу, занятость, промышленное производство и оптово-розничная торговля». [1] This has the advantage of incorporating multiple indicators and different assessments made by a group of experts. A few drawbacks are that recessions are commonly announced with a long time lag, that the specific judgment of committee members may have ad hoc elements or biases, and that the decisions can be hard to reproduce into a general rule. Nevertheless, the NBER recession dates are in widespread use as key timing indicators for historical business cycles.

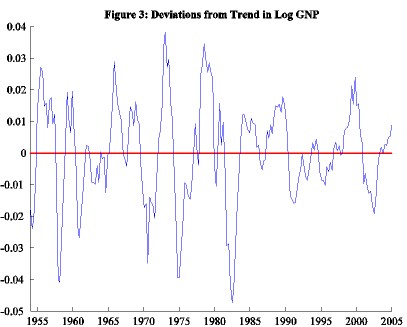

Деловые циклы обычно рассматриваются как среднесрочная эволюция. Они в меньшей степени связаны с долгосрочными тенденциями, обусловленными медленно меняющимися факторами, такими как технологический прогресс. Кроме того, изменение за один период, необычное в течение одного или двух лет, часто относят к «шуму»; примером может служить забастовка рабочих или отдельный период суровой погоды. Это говорит о том, что мы удаляем эти два компонента из данных при оценке движений цикла. Было бы трудно определить конкретные эффекты долговременных или шумных компонентов, рассматривая сложные детали для каждого случая. Однако статистический подход может дать ценную информацию.

Полосовые фильтры были разработаны для экономических данных, чтобы выделить колебания средней частоты. Такие фильтры также привлекательны тем, что предоставляют больше информации о состоянии делового цикла; утверждение о траектории циклического ВВП при выходе из рецессии добавляет интересные факты, помимо простого обозначения того, когда происходит переход от рецессии к росту. Примером полосового фильтра, пытающегося изолировать экономические циклы, является фильтр Кристиано-Фицджеральда. [2] Однако такой фиксированный фильтр сопряжен с существенным риском получения ложных результатов, что делает любое последующее исследование бизнес-цикла вводящим в заблуждение. Этот подход также ограничивается одним показателем.

Адаптивные полосовые фильтры использовались для извлечения бизнес-циклов, соответствующих динамическим свойствам показателей. Фильтры, предложенные Харви-Тримбуром, применялись в многочисленных исследованиях, изучающих различные национальные экономики. [3] В отличие от фиксированного полосового фильтра, который можно применить только к одному индикатору, этот более гибкий подход может использовать несколько переменных в качестве входных данных. Далее можно рассчитывать прогнозы (на своевременной основе). Наконец, неопределенность в деловых циклах можно измерить, что делает их полезными для оценки макроэкономического риска.

Отдельные эпизоды расширения/спада происходят с изменяющейся продолжительностью и интенсивностью с течением времени. Обычно их периодичность имеет широкий диапазон от 2 до 10 лет. Технический термин «стохастический цикл» часто используется в статистике для описания такого рода процесса. Такие гибкие знания о частоте деловых циклов действительно можно включить в их математическое исследование, используя байесовскую статистическую парадигму. [4]

Существуют многочисленные источники движений делового цикла, такие как быстрые и значительные изменения цен на нефть или колебания потребительских настроений, которые влияют на общие расходы в макроэкономике и, следовательно, на инвестиции и прибыль компаний. Обычно такие источники заранее непредсказуемы и могут рассматриваться как случайные «потрясения» циклического характера, как это произошло во время финансовых кризисов 2007–2008 годов или пандемии COVID-19 . За последние десятилетия экономисты и статистики многое узнали о колебаниях бизнес-цикла, исследуя эту тему с различных точек зрения. Примеры методов, которые изучают бизнес-циклы на основе данных, включают фильтры Кристиано-Фицджеральда, Ходрика-Прескотта, сингулярный спектр и фильтры Харви-Тримбура. [2] [5] [6] [7] [3]

История [ править ]

Теория [ править ]

Первым систематическим изложением экономических кризисов , противоречащим существующей теории экономического равновесия , были « Новые принципы политической экономии» Жана Шарля Леонара де Сисмонди (1819) . [8] До этого момента классическая экономика либо отрицала существование деловых циклов, либо отрицала существование деловых циклов. [9] обвиняли в них внешние факторы, в частности войну, [10] или изучал только долгосрочную перспективу. Сисмонди нашел оправдание в панике 1825 года , которая была первым бесспорно международным экономическим кризисом, произошедшим в мирное время. [ нужна ссылка ]

Сисмонди и его современник Роберт Оуэн , выразившие схожие, но менее систематические мысли в «Докладе 1817 года Комитету Ассоциации помощи бедноте обрабатывающей промышленности», оба определили причину экономических циклов как перепроизводство и недостаточное потребление , вызванное, в частности, имущественным неравенством . они выступали за государственное вмешательство и социализм В качестве решения соответственно. Эта работа не вызвала интереса среди экономистов-классиков, хотя теория недостаточного потребления развивалась как неортодоксальная ветвь экономики, пока не была систематизирована в кейнсианской экономической теории в 1930-х годах.

Теория периодических кризисов Сисмонди была развита в теорию чередующихся циклов Шарлем Дюнуайе , [11] и подобные теории, обнаруживающие признаки влияния Сисмонди, были развиты Иоганном Карлом Родбертом . Периодические кризисы капитализма легли в основу теории Карла Маркса , который далее утверждал, что эти кризисы усиливались и на основании чего предсказал коммунистическую революцию . [ нужна ссылка ] Хотя кризисы упоминаются лишь вскользь в «Капитале» (1867), они широко обсуждались в посмертно опубликованных книгах Маркса, особенно в «Теориях прибавочной стоимости» . В книге «Прогресс и бедность » (1879 г.) Генри Джордж сосредоточил внимание на земли роли в кризисах – особенно на спекуляции землей – и предложил единый земельный налог в качестве решения .

Также можно использовать статистическое или эконометрическое моделирование и теорию движения делового цикла. В этом случае анализ временных рядов используется для выявления закономерностей, стохастических сигналов и шума в экономических временных рядах, таких как реальный ВВП или инвестиции. [Харви и Тримбур, 2003, Обзор экономики и статистики ] разработали модели для описания стохастических или псевдоциклов, из которых бизнес-циклы представляют собой ведущий случай. Поскольку хорошо сформированные, компактные и простые в реализации статистические методы могут во многих случаях превосходить макроэкономические подходы, они обеспечивают надежную альтернативу даже довольно сложной экономической теории. [12]

Классификация по периодам [ править ]

В 1860 году французский экономист Клеман Жюглар впервые определил экономические циклы продолжительностью от 7 до 11 лет, хотя он осторожно не заявлял о какой-либо жесткой регулярности. [13] Этот интервал периодичности также является обычным явлением, как эмпирический результат, в моделях временных рядов стохастических циклов экономических данных. Кроме того, такие методы, как статистическое моделирование в байесовской системе – см., например, [Harvey, Trimbur and van Dijk, 2007, Journal of Econometrics ] – могут явно включать такой диапазон, устанавливая априорные значения, которые концентрируются, скажем, в пределах от 6 до 12 лет, такие гибкие знания о частоте деловых циклов действительно могут быть включены в их математическое исследование с использованием байесовской статистической парадигмы. [4]

Позже [ когда? ] Экономист Йозеф Шумпетер утверждал, что цикл Жюглара состоит из четырех стадий:

- Расширение (увеличение производства и цен, низкие процентные ставки)

- Кризис (обвал фондовых бирж и многочисленные банкротства фирм)

- Рецессия (падение цен и производства, высокие процентные ставки)

- Восстановление (запасы восстанавливаются из-за падения цен и доходов)

Модель Жюглара Шумпетера связывает восстановление и процветание с ростом производительности, доверия потребителей , совокупного спроса и цен.

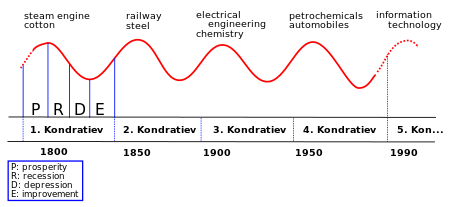

В 20-м веке Шумпетер и другие предложили типологию деловых циклов в соответствии с их периодичностью, так что ряд конкретных циклов был назван в честь их первооткрывателей или авторов: [14]

| Название цикла/волны | Период (лет) |

|---|---|

| Цикл Китчина (инвентарь, например, цикл свинины ) | 3–5 |

| Цикл Жюглара (инвестиции в основной капитал) | 7–11 |

| Кузнецкие качели (инфраструктурные инвестиции) | 15–25 |

| Волна Кондратьева (технологическая основа) | 45–60 |

- Цикл инвентаризации Китчина составляет от 3 до 5 лет (по Джозефу Китчину ) [15]

- цикл Жюглара Инвестиционный с фиксированным сроком от 7 до 11 лет. Для учета колебаний делового цикла необходим диапазон периодов, а не один фиксированный период, что можно сделать с помощью случайного или нерегулярного источника, как в эконометрической или статистической системе.

- продолжительностью Инфраструктурный инвестиционный цикл Кузнеца от 15 до 25 лет (в честь Саймона Кузнеца - также называемый «строительным циклом»)

- или Кондратьевская волна длительный технологический цикл от 45 до 60 лет (по советскому экономисту Николаю Кондратьеву ) [16]

Некоторые говорят, что интерес к различным типологиям циклов ослаб с момента развития современной макроэкономики , которая мало поддерживает идею регулярных периодических циклов. [17] Дальнейшие эконометрические исследования, такие как две работы 2003 и 2007 годов, цитированные выше, демонстрируют четкую тенденцию циклических компонентов в макроэкономические времена вести себя скорее стохастически, чем детерминистически.

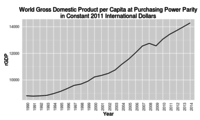

Другие, такие как Дмитрий Орлов , утверждают, что простые сложные проценты вызывают цикличность денежных систем. С 1960 года мировой ВВП увеличился в пятьдесят девять раз, и эти показатели даже не поспевают за годовой инфляцией за тот же период. Коллапс общественного договора (свободы и отсутствие социальных проблем) может наблюдаться в странах, где доходы не поддерживаются в балансе со стоимостью жизни на протяжении всего цикла денежной системы.

Библия (1763 г. до (760 г. до н. э.) и Кодекс Хаммурапи н. э.) объясняют экономические меры по исправлению ситуации с циклическими шестидесятилетними повторяющимися великими депрессиями посредством юбилейного (библейского) пятидесятилетнего года обнуления долга и богатства. [ нужна ссылка ] . В истории зафиксировано тридцать крупных событий по прощению долгов, включая прощение долгов большинству европейских стран в 1930-1954 годах. [18]

Происшествие [ править ]

наблюдался значительный рост производительности , промышленного производства и реального продукта на душу населения. В период с 1870 по 1890 год, который включал длительную депрессию и две другие рецессии, [19] [20] В годы, предшествовавшие Великой депрессии, также наблюдался значительный рост производительности. И Длинная, и Великая депрессии характеризовались избыточными мощностями и насыщением рынка. [21] [22]

За период после промышленной революции технологический прогресс оказал гораздо большее влияние на экономику, чем любые колебания кредита или долга, за исключением Великой депрессии, которая вызвала многолетний резкий экономический спад. Эффект технологического прогресса можно увидеть по покупательной способности среднего часа работы, которая выросла с 3 долларов в 1900 году до 22 долларов в 1990 году, в долларах 2010 года. [23] Аналогичный рост реальной заработной платы наблюдался и в XIX веке. ( См.: Технологии повышения производительности (исторические) .) Таблицу инноваций и длинных циклов можно увидеть по адресу: Волна Кондратьева § Современные модификации теории Кондратьева . Поскольку неожиданные новости в экономике, имеющие случайный аспект, влияют на состояние делового цикла, любые соответствующие описания должны иметь в своей основе случайную часть, которая мотивирует использование статистических основ в этой области.

В XIX и первой половине XX века, особенно в период 1815–1939 годов, в Европе и Америке случались частые кризисы. Этот период начался с окончания наполеоновских войн в 1815 году, за которым сразу же последовала постнаполеоновская депрессия в Соединенном Королевстве (1815–1830 годы), и завершился Великой депрессией 1929–1939 годов, которая привела ко Второй мировой войне . . см. в разделе «Финансовый кризис: 19 век» Список и подробности . Первым из этих кризисов, не связанных с войной, была Паника 1825 года . [24]

Деловые циклы в странах ОЭСР после Второй мировой войны в целом были более сдержанными, чем предыдущие деловые циклы. Это было особенно верно во время Золотого века капитализма (1945/50–1970-е годы), а в период 1945–2008 годов глобальный спад не наблюдался до рецессии в конце 2000-х годов . [25] Политика экономической стабилизации с использованием налогово-бюджетной политики и денежно-кредитной политики, , смягчила худшие проявления деловых циклов, а автоматическая стабилизация благодаря аспектам государственного похоже бюджета также помогла смягчить цикл даже без сознательных действий со стороны политиков. [26]

В этот период экономический цикл – по крайней мере, проблема депрессий – был дважды объявлен мертвым. Первое заявление было сделано в конце 1960-х годов, когда считалось, что кривая Филлипса способна управлять экономикой. Однако за этим последовала стагфляция 1970-х годов, которая дискредитировала теорию. Вторая декларация была сделана в начале 2000-х годов, после стабильности и роста в 1980-х и 1990-х годах в период так называемой Великой умеренности . Примечательно, что в 2003 году Роберт Лукас-младший в своем президентском обращении к Американской экономической ассоциации заявил, что «центральная проблема предотвращения депрессии [была] решена для всех практических целей». [27]

Различные регионы пережили длительную депрессию , наиболее драматично экономический кризис в странах бывшего Восточного блока после распада Советского Союза в 1991 году. Для некоторых из этих стран период 1989–2010 годов был продолжающейся депрессией, при этом реальные доходы все еще были ниже, чем в 1989. [28]

Идентификация [ править ]

В 1946 году экономисты Артур Ф. Бернс и Уэсли К. Митчелл предоставили теперь стандартное определение бизнес-циклов в своей книге «Измерение деловых циклов» : [29]

Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; in duration, business cycles vary from more than one year to ten or twelve years; they are not divisible into shorter cycles of similar characteristics with amplitudes approximating their own.

According to A. F. Burns:[30]

Business cycles are not merely fluctuations in aggregate economic activity. The critical feature that distinguishes them from the commercial convulsions of earlier centuries or from the seasonal and other short term variations of our own age is that the fluctuations are widely diffused over the economy – its industry, its commercial dealings, and its tangles of finance. The economy of the western world is a system of closely interrelated parts. He who would understand business cycles must master the workings of an economic system organized largely in a network of free enterprises searching for profit. The problem of how business cycles come about is therefore inseparable from the problem of how a capitalist economy functions.

In the United States, it is generally accepted that the National Bureau of Economic Research (NBER) is the final arbiter of the dates of the peaks and troughs of the business cycle. An expansion is the period from a trough to a peak and a recession as the period from a peak to a trough. The NBER identifies a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production".[31]

Upper turning points of business cycle, commodity prices and freight rates[edit]

There is often a close timing relationship between the upper turning points of the business cycle, commodity prices, and freight rates, which is shown to be particularly tight in the grand peak years of 1873, 1889, 1900 and 1912.[32] Hamilton expressed that in the post war era, a majority of recessions are connected to an increase in oil price.[33]

Commodity price shocks are considered to be a significant driving force of the US business cycle.[34]

Along these lines, the research in [Trimbur, 2010, International Journal of Forecasting] shows empirical results for the relation between oil-prices and real GDP. The methodology uses a statistical model that incorporate level shifts in the price of crude oil; hence the approach describes the possibility of oil price shocks and forecasts the likelihood of such events.[35]

Indicators[edit]

Economic indicators are used to measure the business cycle: consumer confidence index, retail trade index, unemployment and industry/service production index. Stock and Watson claim that financial indicators' predictive ability is not stable over different time periods because of economic shocks, random fluctuations and development in financial systems.[36] Ludvigson believes consumer confidence index is a coincident indicator as it relates to consumer's current situations.[37] Winton & Ralph state that retail trade index is a benchmark for the current economic level because its aggregate value counts up for two-thirds of the overall GDP and reflects the real state of the economy.[38] According to Stock and Watson, unemployment claim can predict when the business cycle is entering a downward phase.[39] Banbura and Rüstler argue that industry production's GDP information can be delayed as it measures real activity with real number, but it provides an accurate prediction of GDP.[40]

Series used to infer the underlying business cycle fall into three categories: lagging, coincident, and leading. They are described as main elements of an analytic system to forecast peaks and troughs in the business cycle.[41] For almost 30 years, these economic data series are considered as "the leading index" or "the leading indicators"-were compiled and published by the U.S. Department of Commerce.

A prominent coincident, or real-time, business cycle indicator is the Aruoba-Diebold-Scotti Index.

Spectral analysis of business cycles[edit]

Recent research employing spectral analysis has confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance.[42] Korotayev & Tsirel also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third sub-harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.[jargon]

Recurrence quantification analysis[edit]

Recurrence quantification analysis has been employed to detect the characteristic of business cycles and economic development. To this end, Orlando et al.[43] developed the so-called recurrence quantification correlation index to test correlations of RQA on a sample signal and then investigated the application to business time series. The said index has been proven to detect hidden changes in time series. Further, Orlando et al.,[44] over an extensive dataset, shown that recurrence quantification analysis may help in anticipating transitions from laminar (i.e. regular) to turbulent (i.e. chaotic) phases such as USA GDP in 1949, 1953, etc. Last but not least, it has been demonstrated that recurrence quantification analysis can detect differences between macroeconomic variables and highlight hidden features of economic dynamics.[44]

Cycles or fluctuations?[edit]

The Business Cycle follows changes in stock prices which are mostly caused by external factors such as socioeconomic conditions, inflation, exchange rates. Intellectual capital does not affect a company stock's current earnings. Intellectual capital contributes to a stock's return growth.[45]

Unlike long-term trends, medium-term data fluctuations are connected to the monetary policy transmission mechanism and its role in regulating inflation during an economic cycle. At the same time, the presence of nominal restrictions in price setting behavior might impact the short-term course of inflation.[46]

In recent years economic theory has moved towards the study of economic fluctuation rather than a "business cycle"[47] – though some economists use the phrase 'business cycle' as a convenient shorthand. For example, Milton Friedman said that calling the business cycle a "cycle" is a misnomer, because of its non-cyclical nature. Friedman believed that for the most part, excluding very large supply shocks, business declines are more of a monetary phenomenon.[48] Arthur F. Burns and Wesley C. Mitchell define business cycle as a form of fluctuation. In economic activities, a cycle of expansions happening, followed by recessions, contractions, and revivals. All of which combine to form the next cycle's expansion phase; this sequence of change is repeated but not periodic.[49]

Proposed explanations[edit]

The explanation of fluctuations in aggregate economic activity is one of the primary concerns of macroeconomics and a variety of theories have been proposed to explain them.

Exogenous vs. endogenous[edit]

Within economics, it has been debated as to whether or not the fluctuations of a business cycle are attributable to external (exogenous) versus internal (endogenous) causes. In the first case shocks are stochastic, in the second case shocks are deterministically chaotic and embedded in the economic system.[50] The classical school (now neo-classical) argues for exogenous causes and the underconsumptionist (now Keynesian) school argues for endogenous causes. These may also broadly be classed as "supply-side" and "demand-side" explanations: supply-side explanations may be styled, following Say's law, as arguing that "supply creates its own demand", while demand-side explanations argue that effective demand may fall short of supply, yielding a recession or depression.

This debate has important policy consequences: proponents of exogenous causes of crises such as neoclassicals largely argue for minimal government policy or regulation (laissez faire), as absent these external shocks, the market functions, while proponents of endogenous causes of crises such as Keynesians largely argue for larger government policy and regulation, as absent regulation, the market will move from crisis to crisis. This division is not absolute – some classicals (including Say) argued for government policy to mitigate the damage of economic cycles, despite believing in external causes, while Austrian School economists argue against government involvement as only worsening crises, despite believing in internal causes.

The view of the economic cycle as caused exogenously dates to Say's law, and much debate on endogeneity or exogeneity of causes of the economic cycle is framed in terms of refuting or supporting Say's law; this is also referred to as the "general glut" (supply in relation to demand) debate.

Until the Keynesian revolution in mainstream economics in the wake of the Great Depression, classical and neoclassical explanations (exogenous causes) were the mainstream explanation of economic cycles; following the Keynesian revolution, neoclassical macroeconomics was largely rejected. There has been some resurgence of neoclassical approaches in the form of real business cycle (RBC) theory. The debate between Keynesians and neo-classical advocates was reawakened following the recession of 2007.

Mainstream economists working in the neoclassical tradition, as opposed to the Keynesian tradition, have usually viewed the departures of the harmonic working of the market economy as due to exogenous influences, such as the State or its regulations, labor unions, business monopolies, or shocks due to technology or natural causes.

Contrarily, in the heterodox tradition of Jean Charles Léonard de Sismondi, Clément Juglar, and Marx the recurrent upturns and downturns of the market system are an endogenous characteristic of it.[51]

The 19th-century school of under consumptionism also posited endogenous causes for the business cycle, notably the paradox of thrift, and today this previously heterodox school has entered the mainstream in the form of Keynesian economics via the Keynesian revolution.

Mainstream economics[edit]

Mainstream economics views business cycles as essentially "the random summation of random causes". In 1927, Eugen Slutzky observed that summing random numbers, such as the last digits of the Russian state lottery, could generate patterns akin to that we see in business cycles, an observation that has since been repeated many times. This caused economists to move away from viewing business cycles as a cycle that needed to be explained and instead viewing their apparently cyclical nature as a methodological artefact. This means that what appear to be cyclical phenomena can actually be explained as just random events that are fed into a simple linear model. Thus business cycles are essentially random shocks that average out over time. Mainstream economists have built models of business cycles based the idea that they are caused by random shocks.[52][53][54] Due to this inherent randomness, recessions can sometimes not occur for decades; for example, Australia did not experience any recession between 1991 and 2020.[55]

While economists have found it difficult to forecast recessions or determine their likely severity, research indicates that longer expansions do not cause following recessions to be more severe.[56]

Keynesian[edit]

According to Keynesian economics, fluctuations in aggregate demand cause the economy to come to short run equilibrium at levels that are different from the full employment rate of output. These fluctuations express themselves as the observed business cycles. Keynesian models do not necessarily imply periodic business cycles. However, simple Keynesian models involving the interaction of the Keynesian multiplier and accelerator give rise to cyclical responses to initial shocks. Paul Samuelson's "oscillator model"[57] is supposed to account for business cycles thanks to the multiplier and the accelerator. The amplitude of the variations in economic output depends on the level of the investment, for investment determines the level of aggregate output (multiplier), and is determined by aggregate demand (accelerator).

In the Keynesian tradition, Richard Goodwin[58] accounts for cycles in output by the distribution of income between business profits and workers' wages. The fluctuations in wages are almost the same as in the level of employment (wage cycle lags one period behind the employment cycle), for when the economy is at high employment, workers are able to demand rises in wages, whereas in periods of high unemployment, wages tend to fall. According to Goodwin, when unemployment and business profits rise, the output rises.

Cyclical behavior of exports and imports[edit]

Exports and imports are large components of an economy's aggregate expenditure, especially one that is oriented toward international trade. Income is an essential determinant of the level of imported goods. A higher GDP reflects a higher level of spending on imported goods and services, and vice versa. Therefore, expenditure on imported goods and services fall during a recession and rise during an economic expansion or boom.[59]

Import expenditures are commonly considered to be procyclical and cyclical in nature, coincident with the business cycle.[59] Domestic export expenditures give a good indication of foreign business cycles as foreign import expenditures are coincident with the foreign business cycle.

Credit/debt cycle[edit]

One alternative theory is that the primary cause of economic cycles is due to the credit cycle: the net expansion of credit (increase in private credit, equivalently debt, as a percentage of GDP) yields economic expansions, while the net contraction causes recessions, and if it persists, depressions. In particular, the bursting of speculative bubbles is seen as the proximate cause of depressions, and this theory places finance and banks at the center of the business cycle.

A primary theory in this vein is the debt deflation theory of Irving Fisher, which he proposed to explain the Great Depression. A more recent complementary theory is the Financial Instability Hypothesis of Hyman Minsky, and the credit theory of economic cycles is often associated with Post-Keynesian economics such as Steve Keen.

Post-Keynesian economist Hyman Minsky has proposed an explanation of cycles founded on fluctuations in credit, interest rates and financial frailty, called the Financial Instability Hypothesis. In an expansion period, interest rates are low and companies easily borrow money from banks to invest. Banks are not reluctant to grant them loans, because expanding economic activity allows business increasing cash flows and therefore they will be able to easily pay back the loans. This process leads to firms becoming excessively indebted, so that they stop investing, and the economy goes into recession.

While credit causes have not been a primary theory of the economic cycle within the mainstream, they have gained occasional mention, such as (Eckstein & Sinai 1990), cited approvingly by (Summers 1986).

Real business-cycle theory[edit]

Within mainstream economics, Keynesian views have been challenged by real business cycle models in which fluctuations are due to random changes in the total productivity factor (which are caused by changes in technology as well as the legal and regulatory environment). This theory is most associated with Finn E. Kydland and Edward C. Prescott, and more generally the Chicago school of economics (freshwater economics). They consider that economic crisis and fluctuations cannot stem from a monetary shock, only from an external shock, such as an innovation.[52]

Product based theory of economic cycles[edit]

This theory explains the nature and causes of economic cycles from the viewpoint of life-cycle of marketable goods.[60] The theory originates from the work of Raymond Vernon, who described the development of international trade in terms of product life-cycle – a period of time during which the product circulates in the market. Vernon stated that some countries specialize in the production and export of technologically new products, while others specialize in the production of already known products. The most developed countries are able to invest large amounts of money in the technological innovations and produce new products, thus obtaining a dynamic comparative advantage over developing countries.

Recent research by Georgiy Revyakin proved initial Vernon theory and showed economic cycles in developed countries overran economic cycles in developing countries.[61] He also presumed economic cycles with different periodicity can be compared to the products with various life-cycles. In case of Kondratiev waves such products correlate with fundamental discoveries implemented in production (inventions which form the technological paradigm: Richard Arkwright's machines, steam engines, industrial use of electricity, computer invention, etc.); Kuznets cycles describe such products as infrastructural components (roadways, transport, utilities, etc.); Juglar cycles may go in parallel with enterprise fixed capital (equipment, machinery, etc.), and Kitchin cycles are characterized by change in the society preferences (tastes) for consumer goods, and time, which is necessary to start the production.

Highly competitive market conditions would determine simultaneous technological updates of all economic agents (as a result, cycle formation): in case if a manufacturing technology at an enterprise does not meet the current technological environment – such company loses its competitiveness and eventually goes bankrupt.

Political business cycle[edit]

Another set of models tries to derive the business cycle from political decisions. The political business cycle theory is strongly linked to the name of Michał Kalecki who discussed "the reluctance of the 'captains of industry' to accept government intervention in the matter of employment".[62] Persistent full employment would mean increasing workers' bargaining power to raise wages and to avoid doing unpaid labor, potentially hurting profitability. However, he did not see this theory as applying under fascism, which would use direct force to destroy labor's power.

In recent years, proponents of the "electoral business cycle" theory have argued that incumbent politicians encourage prosperity before elections in order to ensure re-election – and make the citizens pay for it with recessions afterwards.[63] The political business cycle is an alternative theory stating that when an administration of any hue is elected, it initially adopts a contractionary policy to reduce inflation and gain a reputation for economic competence. It then adopts an expansionary policy in the lead up to the next election, hoping to achieve simultaneously low inflation and unemployment on election day.[64]

The partisan business cycle suggests that cycles result from the successive elections of administrations with different policy regimes. Regime A adopts expansionary policies, resulting in growth and inflation, but is voted out of office when inflation becomes unacceptably high. The replacement, Regime B, adopts contractionary policies reducing inflation and growth, and the downwards swing of the cycle. It is voted out of office when unemployment is too high, being replaced by Party A.

Marxian economics[edit]

For Marx, the economy based on production of commodities to be sold in the market is intrinsically prone to crisis. In the heterodox Marxian view, profit is the major engine of the market economy, but business (capital) profitability has a tendency to fall that recurrently creates crises in which mass unemployment occurs, businesses fail, remaining capital is centralized and concentrated and profitability is recovered. In the long run, these crises tend to be more severe and the system will eventually fail.[65]

Some Marxist authors such as Rosa Luxemburg viewed the lack of purchasing power of workers as a cause of a tendency of supply to be larger than demand, creating crisis, in a model that has similarities with the Keynesian one. Indeed, a number of modern authors have tried to combine Marx's and Keynes's views. Henryk Grossman[66] reviewed the debates and the counteracting tendencies and Paul Mattick subsequently emphasized the basic differences between the Marxian and the Keynesian perspective. While Keynes saw capitalism as a system worth maintaining and susceptible to efficient regulation, Marx viewed capitalism as a historically doomed system that cannot be put under societal control.[67]

The American mathematician and economist Richard M. Goodwin formalised a Marxist model of business cycles known as the Goodwin Model in which recession was caused by increased bargaining power of workers (a result of high employment in boom periods) pushing up the wage share of national income, suppressing profits and leading to a breakdown in capital accumulation. Later theorists applying variants of the Goodwin model have identified both short and long period profit-led growth and distribution cycles in the United States and elsewhere.[68][69][70][71][72] David Gordon provided a Marxist model of long period institutional growth cycles in an attempt to explain the Kondratiev wave. This cycle is due to the periodic breakdown of the social structure of accumulation, a set of institutions which secure and stabilize capital accumulation.

Austrian School[edit]

Economists of the heterodox Austrian School argue that business cycles are caused by excessive issuance of credit by banks in fractional reserve banking systems. According to Austrian economists, excessive issuance of bank credit may be exacerbated if central bank monetary policy sets interest rates too low, and the resulting expansion of the money supply causes a "boom" in which resources are misallocated or "malinvested" because of artificially low interest rates. Eventually, the boom cannot be sustained and is followed by a "bust" in which the malinvestments are liquidated (sold for less than their original cost) and the money supply contracts.[73][74]

One of the criticisms of the Austrian business cycle theory is based on the observation that the United States suffered recurrent economic crises in the 19th century, notably the Panic of 1873, which occurred prior to the establishment of a U.S. central bank in 1913. Adherents of the Austrian School, such as the historian Thomas Woods, argue that these earlier financial crises were prompted by government and bankers' efforts to expand credit despite restraints imposed by the prevailing gold standard, and are thus consistent with Austrian Business Cycle Theory.[75][76]

The Austrian explanation of the business cycle differs significantly from the mainstream understanding of business cycles and is generally rejected by mainstream economists. Mainstream economists generally do not support Austrian school explanations for business cycles, on both theoretical as well as real-world empirical grounds.[77][78][79][80][81][82] Austrians claim that the boom-and-bust business cycle is caused by government intervention into the economy, and that the cycle would be comparatively rare and mild without central government interference.

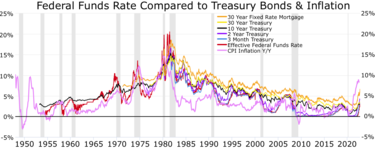

Yield curve[edit]

The slope of the yield curve is one of the most powerful predictors of future economic growth, inflation, and recessions.[83] One measure of the yield curve slope (i.e. the difference between 10-year Treasury bond rate and the 3-month Treasury bond rate) is included in the Financial Stress Index published by the St. Louis Fed.[84] A different measure of the slope (i.e. the difference between 10-year Treasury bond rates and the federal funds rate) is incorporated into the Index of Leading Economic Indicators published by The Conference Board.[85]

An inverted yield curve is often a harbinger of recession. A positively sloped yield curve is often a harbinger of inflationary growth. Work by Arturo Estrella and Tobias Adrian has established the predictive power of an inverted yield curve to signal a recession. Their models show that when the difference between short-term interest rates (they use 3-month T-bills) and long-term interest rates (10-year Treasury bonds) at the end of a federal reserve tightening cycle is negative or less than 93 basis points positive that a rise in unemployment usually occurs.[86] The New York Fed publishes a monthly recession probability prediction derived from the yield curve and based on Estrella's work.

All the recessions in the United States since 1970 (up through 2017) have been preceded by an inverted yield curve (10-year vs. 3-month). Over the same time frame, every occurrence of an inverted yield curve has been followed by recession as declared by the NBER business cycle dating committee.[87]

| Event | Date of inversion start | Date of the recession start | Time from inversion to recession Start | Duration of inversion | Time from recession start to NBER announcement | Time from disinversion to recession end | Duration of recession | Time from recession end to NBER announcement | Max inversion |

|---|---|---|---|---|---|---|---|---|---|

| Months | Months | Months | Months | Months | Months | Basis points | |||

| 1970 recession | December 1968 | January 1970 | 13 | 15 | NA | 8 | 11 | NA | −52 |

| 1974 recession | June 1973 | December 1973 | 6 | 18 | NA | 3 | 16 | NA | −159 |

| 1980 recession | November 1978 | February 1980 | 15 | 18 | 4 | 2 | 6 | 12 | −328 |

| 1981–1982 recession | October 1980 | August 1981 | 10 | 12 | 5 | 13 | 16 | 8 | −351 |

| 1990 recession | June 1989 | August 1990 | 14 | 7 | 8 | 14 | 8 | 21 | −16 |

| 2001 recession | July 2000 | April 2001 | 9 | 7 | 7 | 9 | 8 | 20 | −70 |

| 2008–2009 recession | August 2006 | January 2008 | 17 | 10 | 11 | 24 | 18 | 15 | −51 |

| 2020–2020 recession | March 2020 | April 2020 | |||||||

| Average since 1969 | 12 | 12 | 7 | 10 | 12 | 15 | −147 | ||

| Standard deviation since 1969 | 3.83 | 4.72 | 2.74 | 7.50 | 4.78 | 5.45 | 138.96 |

Estrella and others have postulated that the yield curve affects the business cycle via the balance sheet of banks (or bank-like financial institutions).[88] When the yield curve is inverted banks are often caught paying more on short-term deposits (or other forms of short-term wholesale funding) than they are making on long-term loans leading to a loss of profitability and reluctance to lend resulting in a credit crunch. When the yield curve is upward sloping, banks can profitably take-in short term deposits and make long-term loans so they are eager to supply credit to borrowers. This eventually leads to a credit bubble.

Georgism[edit]

Henry George claimed land price fluctuations were the primary cause of most business cycles.[89]

Mitigating an economic downturn[edit]

Many social indicators, such as mental health, crimes, and suicides, worsen during economic recessions (though general mortality tends to fall, and it is in expansions when it tends to increase).[90] As periods of economic stagnation are painful for the many who lose their jobs, there is often political pressure for governments to mitigate recessions. Since the 1940s, following the Keynesian Revolution, most governments of developed nations have seen the mitigation of the business cycle as part of the responsibility of government, under the rubric of stabilization policy.[91]

Since in the Keynesian view, recessions are caused by inadequate aggregate demand, when a recession occurs the government should increase the amount of aggregate demand and bring the economy back into equilibrium. This the government can do in two ways, firstly by increasing the money supply (expansionary monetary policy) and secondly by increasing government spending or cutting taxes (expansionary fiscal policy).

By contrast, some economists, notably New classical economist Robert Lucas, argue that the welfare cost of business cycles are very small to negligible, and that governments should focus on long-term growth instead of stabilization.

However, even according to Keynesian theory, managing economic policy to smooth out the cycle is a difficult task in a society with a complex economy. Some theorists, notably those who believe in Marxian economics, believe that this difficulty is insurmountable. Karl Marx claimed that recurrent business cycle crises were an inevitable result of the operations of the capitalistic system. In this view, all that the government can do is to change the timing of economic crises. The crisis could also show up in a different form, for example as severe inflation or a steadily increasing government deficit. Worse, by delaying a crisis, government policy is seen as making it more dramatic and thus more painful.

Additionally, since the 1960s neoclassical economists have played down the ability of Keynesian policies to manage an economy. Since the 1960s, economists like Nobel Laureates Milton Friedman and Edmund Phelps have made ground in their arguments that inflationary expectations negate the Phillips curve in the long run. The stagflation of the 1970s provided striking support for their theories while proving a dilemma for Keynesian policies, which appeared to necessitate both expansionary policies to mitigate recession and contractionary policies to reduce inflation.Friedman has gone so far as to argue that all the central bank of a country should do is to avoid making large mistakes, as he believes they did by contracting the money supply very rapidly in the face of the Wall Street Crash of 1929, in which they made what would have been a recession into the Great Depression.[citation needed]

Software[edit]

The Hodrick-Prescott [5] and the Christiano-Fitzgerald [2] filters can be implemented using the R package mFilter, while singular spectrum filters [6][7] can be implemented using the R package ASSA.

See also[edit]

Notes[edit]

- ^ "Business Cycle Dating Committee Announcement January 7, 2008". www.nber.org. 2008-01-07.

- ^ Jump up to: a b c Christiano, L.; Fitzgerald, T. (2017). "The band-pass filter". International Economic Review. 44 (2): 435–465. doi:10.1111/1468-2354.t01-1-00076.

- ^ Jump up to: a b Harvey, Andrew C.; Trimbur, Thomas M. (2003). "General Model-Based Filters for Extracting Trends and Cycles in Economic Time Series" (PDF). Review of Economics and Statistics. 85 (2): 244–255. doi:10.1162/003465303765299774. S2CID 57567527.

- ^ Jump up to: a b Harvey, Andrew C.; Trimbur, Thomas M.; van Dijk, Herman C. (2007). "Trends and cycles in economic time series: A Bayesian approach". Journal of Econometrics. 140 (2): 618–649. doi:10.1016/j.jeconom.2006.07.006. hdl:1765/6913.

- ^ Jump up to: a b Hodrick, R.; Prescott, E. (1997). "Postwar US business cycles: An empirical investigation". Journal of Money, Credit and Banking. 29 (1): 1–16. doi:10.2307/2953682. JSTOR 2953682. S2CID 154995815.

- ^ Jump up to: a b de Carvalho, M.; Rua, A. (2017). "Real-time nowcasting the US output gap: Singular spectrum analysis at work". International Journal of Forecasting. 33: 185–198. doi:10.1016/j.ijforecast.2015.09.004. S2CID 44189755.

- ^ Jump up to: a b de Carvalho, M.; Rodrigues, P. C.; Rua, A. (2012). "Real-time nowcasting the US output gap: Singular spectrum analysis at work". Economics Letters. 114: 32‒35. doi:10.1016/j.ijforecast.2015.09.004. S2CID 44189755.

- ^ "Over Production and Under Consumption" Archived 2009-04-25 at the Wayback Machine, ScarLett, History Of Economic Theory and Thought

- ^ Batra, R. (2002). "Economics in Crisis: Severe and Logical Contradictions of Classical, Keynesian, and Popular Trade Models".

- ^ "Classical Economists, Good or Bad?". Archived from the original on 2009-10-02.

- ^ Benkemoune, Rabah (2009). "Charles Dunoyer and the Emergence of the Idea of an Economic Cycle". History of Political Economy. 41 (2): 271–295. doi:10.1215/00182702-2009-003.

- ^ Harvey, Andrew C.; Trimbur, Thomas M. (2003). "General model based filters for extracting trends and cycles in economic time series" (PDF). Review of Economics and Statistics. 85 (2): 244–255. doi:10.1162/003465303765299774. S2CID 57567527.

- ^ M. W. Lee, Economic fluctuations. Homewood, IL, Richard D. Irwin, 1955

- ^ Schumpeter, J. A. (1954). History of Economic Analysis. London: George Allen & Unwin.

- ^ Kitchin, Joseph (1923). "Cycles and Trends in Economic Factors". Review of Economics and Statistics. 5 (1): 10–16. doi:10.2307/1927031. JSTOR 1927031.

- ^ Kondratieff, N. D.; Stolper, W. F. (1935). "The Long Waves in Economic Life". Review of Economics and Statistics. 17 (6): 105–115. doi:10.2307/1928486. JSTOR 1928486.

- ^ "Business cycle notes" (PDF). Archived from the original (PDF) on 2014-01-25. Retrieved 2014-09-22.

- ^ Khan, Mejreen (2 February 2015). "The biggest debt forgiveness write-offs in the history of the world – Telegraph". Telegraph.co.uk. Archived from the original on 2022-01-12. Retrieved 2018-12-10.

- ^ Wells, David A. (1890). Recent Economic Changes and Their Effect on Production and Distribution of Wealth and Well-Being of Society. New York: D. Appleton and Co. ISBN 978-0543724748.

RECENT ECONOMIC CHANGES AND THEIR EFFECT ON DISTRIBUTION OF WEALTH AND WELL BEING OF SOCIETY WELLS.

- ^ Rothbard, Murray (2002). History of Money and Banking in the United States (PDF). Ludwig Von Mises Inst. ISBN 978-0945466338. Archived (PDF) from the original on 2014-02-10.

- ^ Wells, David A. (1890). Recent Economic Changes and Their Effect on Production and Distribution of Wealth and Well-Being of Society. New York: D. Appleton and Co. ISBN 978-0543724748.

RECENT ECONOMIC CHANGES AND THEIR EFFECT ON DISTRIBUTION OF WEALTH AND WELL BEING OF SOCIETY WELLS.

Opening line of the Preface. - ^ Beaudreau, Bernard C. (1996). Mass Production, the Stock Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

- ^ Lebergott, Stanley (1993). Pursuing Happiness: American Consumers in the Twentieth Century. Princeton, NJ: Princeton University Press. pp. a:Adapted from Fig. 9.1. ISBN 978-0691043227.

- ^ Shallat, Todd (February 2004). "The Rhine: An Eco-Biography, 1815–2000". The Public Historian. 26 (1): 163–164. doi:10.1525/tph.2004.26.1.163. ISSN 0272-3433.

- ^ "Investment company institute - Perspective" (PDF). Archived (PDF) from the original on 2013-03-13. Retrieved 2013-08-01. Stock Market Cycles 1942–1995

- ^ "Business Cycles versus Boom-and-Bust Cycles", Economic and Financial Crises, Palgrave Macmillan, 2015, doi:10.1057/9781137461902.0009, ISBN 978-1-137-46190-2

- ^ Fighting Off Depression, New York Times, Krugman, Paul (5 January 2009). "Opinion | Fighting off Depression". The New York Times. Archived from the original on 2011-04-30. Retrieved 2009-08-15.

- ^ Smith, Adrian; Swain, Adam (January 2010). "The Global Economic Crisis, Eastern Europe, and the Former Soviet Union: Models of Development and the Contradictions of Internationalization". Eurasian Geography and Economics. 51 (1): 1–34. doi:10.2747/1539-7216.51.1.1. ISSN 1538-7216. S2CID 154302466.

- ^ A. F. Burns and W. C. Mitchell, Measuring business cycles, New York, National Bureau of Economic Research, 1946.

- ^ A. F. Burns, Introduction. In: Wesley C. Mitchell, What happens during business cycles: A progress report. New York, National Bureau of Economic Research, 1951

- ^ "US Business Cycle Expansions and Contractions". NBER. Archived from the original on February 19, 2009. Retrieved 2009-02-20.

- ^ Jan Tore Klovland "EconPapers: New evidence on the fluctuations in ocean freight rates in the 1850s". Archived from the original on 2014-02-22. Retrieved 2013-07-30.

- ^ Hamilton, J. D. (2008). Oil and the macroeconomy, in S. N. Durlauf & L. E. Blume, eds, "The New Palgrave Dictionary of Economics".

- ^ Gubler, M., & Hertweck, M.S. (2013). (p. 3-6). "Commodity Price Shocks and the Business Cycle: Structural Evidence for the U.S".

- ^ Trimbur, Thomas M. (2010). "Stochastic outliers and levels in time series with application to oil prices". International Journal of Forecasting.

- ^ Stock, J.H., & Watson, M.W. (1999). (pp. 3–14). "Business Cycle Fluctuations in US Macroeconomic Time Series", Amsterdam: Elsevier.

- ^ Ludvigson, S.C. (2004). (pp. 29–45). "Consumer Confidence and Consumer Spending. Journal of Economic Perspectives."

- ^ Winton, J., & Ralph, J. (2011). (p. 88). "Measuring the accuracy of the Retail Sales Index. Economic and Labour Market Review".

- ^ Stock, J.H., & Watson, M.W. (2003a). (pp. 71–80). "How Did Leading Indicators Forecasts Perform During the 2001 Recession?. Economic Quarterly – Federal Reserve Bank of Richmond".

- ^ Banbura, A., & Rüstler, G. (2011). (pp. 333–342). "A Look Into the Factor Model Black Box: Publication Lags and the Role of Hard and Soft Data in Forecasting GDP. International Journal of Forecasting".

- ^ The Conference Board (2021). https://conference-board.org/data/bci/index.cfm?id=2151.

- ^ See, e.g. Korotayev, Andrey V., & Tsirel, Sergey V. A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis Archived 2010-06-15 at the Wayback Machine. Structure and Dynamics. 2010. Vol. 4. no. 1. pp. 3–57.

- ^ Orlando, Giuseppe; Zimatore, Giovanna (18 December 2017). "RQA correlations on real business cycles time series". Indian Academy of Sciences – Conference Series. 1 (1): 35–41. doi:10.29195/iascs.01.01.0009.

- ^ Jump up to: a b Orlando, Giuseppe; Zimatore, Giovanna (1 May 2018). "Recurrence quantification analysis of business cycles". Chaos, Solitons & Fractals. 110: 82–94. Bibcode:2018CSF...110...82O. doi:10.1016/j.chaos.2018.02.032. ISSN 0960-0779. S2CID 85526993.

- ^ copied from Wikipedia article Intellectual capital The Impact of Intellectual Capital on a Firm’s Stock Return | Evidence from Indonesia | Ari Barkah Djamil, Dominique Razafindrambinina, Caroline Tandeans | Journal of Business Studies Quarterly 2013, Volume 5, Number 2

- ^ Mkrtchyan, Ashot; Dabla-Norris, Era; Stepanyan, Ara (2009-03-01). "A New Keynesian Model of the Armenian Economy". Rochester, NY. SSRN 1372944.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Mankiw, Gregory (1989). "Real Business Cycles: A New Keynesian Perspective". The Journal of Economic Perspectives. 3 (3): 79–90. doi:10.1257/jep.3.3.79. ISSN 0895-3309. JSTOR 1942761.

- ^ Schwartz, Anna J. (1987). Money in Historical Perspective. University of Chicago Press. pp. 24–77. ISBN 978-0226742281.

- ^ Arthur F. Burns and Wesley C. Mitchell. (1946). (p.3). "Measuring Business Cycles."

- ^ Orlando, Giuseppe; Zimatore, Giovanna (August 2020). "Business cycle modeling between financial crises and black swans: Ornstein–Uhlenbeck stochastic process vs Kaldor deterministic chaotic model". Chaos: An Interdisciplinary Journal of Nonlinear Science. 30 (8): 083129. Bibcode:2020Chaos..30h3129O. doi:10.1063/5.0015916. PMID 32872798. S2CID 235909725.

- ^ Morgan, Mary S. (1990). The History of Econometric Ideas. New York: Cambridge University Press. pp. 15–130. ISBN 978-0521373982.

- ^ Jump up to: a b Drautzburg, Thorsten. "Why Are Recessions So Hard to Predict? Random Shocks and Business Cycles." Economic Insights 4, no. 1 (2019): 1–8.

- ^ Slutzky, Eugen. "The summation of random causes as the source of cyclic processes." Econometrica: Journal of the Econometric Society (1937): 105–146.

- ^ Chatterjee, Satyajit. "From cycles to shocks: Progress in business cycle theory." Business Review 3 (2000): 27–37.

- ^ Isabella Kwai. "Australia’s First Recession in Decades Signals Tougher Times to Come."[1] New York Times, 09.02.20

- ^ Tasci, Murat, and Nicholas Zevanove. "Do Longer Expansions Lead to More Severe Recessions?." Economic Commentary 2019-02 (2019).

- ^ Samuelson, P. A. (1939). "Interactions between the multiplier analysis and the principle of acceleration". Review of Economic Statistics. 21 (2): 75–78. doi:10.2307/1927758. JSTOR 1927758.

- ^ R. M. Goodwin (1967) "A Growth Cycle", in C.H. Feinstein, editor, Socialism, Capitalism and Economic Growth. Cambridge: Cambridge University Press

- ^ Jump up to: a b Acemoglu, Daron (2018). Macroeconomics. David I. Laibson, John A. List (Second ed.). New York. ISBN 978-0-13-449205-6. OCLC 956396690.

{{cite book}}: CS1 maint: location missing publisher (link) - ^ Vernon, R. (1966). "International Investment and International Trade in the Product Cycle". Quarterly Journal of Economics. 5 (2): 22–26. doi:10.2307/1880689. JSTOR 1880689.

- ^ Revyakin, G. (2017). "A new approach to the nature of economic cycles and their analysis in the global context". Eureka: Social and Humanities. 5: 27–37. doi:10.21303/2504-5571.2017.00425.

- ^ Kalecki, Michal (January 1970). "Political Aspects of Full Employment". Archived from the original on 7 April 2012. Retrieved 2 May 2012.

- ^ Rogoff, Kenneth; Sibert, Anne (January 1988). "Elections and Macroeconomic Policy Cycles". Review of Economic Studies. 55 (181): 1–16. doi:10.3386/w1838.

- ^ • Allan Drazen, 2008. "political business cycles", The New Palgrave Dictionary of Economics, 2nd Edition. Abstract. Archived 2010-12-29 at the Wayback Machine

• William D. Nordhaus, 1975. "The Political Business Cycle", Review of Economic Studies, 42(2), pp. 169–190.

• _____, 1989:2. "Alternative Approaches to the Political Business Cycle", Brookings Papers on Economic Activity, p pp. 1–68. - ^ Henryk Grossmann Das Akkumulations – und Zusammenbruchsgesetz des kapitalistischen Systems (Zugleich eine Krisentheorie), Hirschfeld, Leipzig, 1929

- ^ Grossman, Henryk The Law of Accumulation and Breakdown of the Capitalist System. Pluto

- ^ Paul Mattick, Marx and Keynes: The Limits of Mixed Economy, Boston, Porter Sargent, 1969

- ^ Barbosa-Filho, Nelson H.; Taylor, Lance (2006). "Distributive and Demand Cycles in the US Economy – A Structuralist Goodwin Model". Metroeconomica. 57 (3): 389–411. doi:10.1111/j.1467-999x.2006.00250.x. S2CID 153733257.

- ^ Peter Flaschel, G. Kauermann, and T. Teuber, 'Long Cycles in Employment, Inflation and Real Wage Costs', American Journal of Applied Sciences Special Issue (2008): 69–77

- ^ Mamadou Bobo Diallo et al., 'Reconsidering the Dynamic Interaction Between Real Wages and Macroeconomic Activity', Research in World Economy 2, no. 1 (April 2011)

- ^ Reiner Franke, Peter Flaschel, and Christian R. Proaño, 'Wage–price Dynamics and Income Distribution in a Semi-structural Keynes–Goodwin Model', Structural Change and Economic Dynamics 17, no. 4 (December 2006): 452–465

- ^ Cámara Izquierdo, Sergio (2013). "The cyclical decline of the profit rate as the cause of crises in the U.S. (1947–2011)". Review of Radical Political Economics. 45 (4): 459–467.

- ^ Block, Walter; Garschina, Kenneth (20 July 2005). "Hayek, Business Cycles and Fractional Reserve Banking: Continuing the De-Homogenization Process" (PDF). www.mises.org. Ludwig von Mises Institute. Archived (PDF) from the original on 10 September 2013. Retrieved 28 July 2014.

- ^ Shostak, Dr. Frank. "Fractional Reserve banking and boom-bust cycles" (PDF). www.mises.org. Ludwig von Mises Institute. Archived (PDF) from the original on 14 July 2012. Retrieved 28 July 2014.

- ^ Woods, Thomas Jr. "Can We Live Without the Fed?". www.lewrockwell.com. Lew Rockwell. Archived from the original on 13 March 2014. Retrieved 27 July 2014.

- ^ Woods, Thomas Jr. "Economic Cycles Before the Fed". www.youtube.com. Mises Media. Archived from the original on 12 September 2014. Retrieved 27 July 2014.

- ^ Friedman, Milton. "The Monetary Studies of the National Bureau, 44th Annual Report". The Optimal Quantity of Money and Other Essays. Chicago: Aldine. pp. 261–284.

- ^ Friedman, Milton. "The 'Plucking Model' of Business Fluctuations Revisited". Economic Inquiry: 171–177.

- ^ Keeler, JP. (2001). "Empirical Evidence on the Austrian Business Cycle Theory". Review of Austrian Economics. 14 (4): 331–51. doi:10.1023/A:1011937230775. S2CID 18902379.

- ^ Interview in Barron's Magazine, Aug. 24, 1998 archived at Hoover Institution "Mr. Market | Hoover Institution". Archived from the original on 2013-12-31. Retrieved 2015-09-28.

- ^ Nicholas Kaldor (1942). "Professor Hayek and the Concertina-Effect". Economica. 9 (36): 359–382. doi:10.2307/2550326. JSTOR 2550326.

- ^ R. W. Garrison, "F. A. Hayek as 'Mr. Fluctooations:' In Defense of Hayek's 'Technical Economics'" Archived 2011-08-08 at the Wayback Machine, Hayek Society Journal (LSE), 5(2), 1 (2003).

- ^ Estrella, Arturo; Mishkin, Frederic S. (1998). "Predicting U.S. Recessions: Financial Variables as Leading Indicators" (PDF). Review of Economics and Statistics. 80: 45–61. doi:10.1162/003465398557320. S2CID 11641969.

- ^ "List of Data Series Used to Construct the St. Louis Fed Financial Stress Index". The Federal Reserve Bank of St. Louis. 31 December 1993. Archived from the original on 2 April 2015. Retrieved 2 March 2015.

- ^ "Description of Components". Business Cycle Indicators. The Conference Board. Archived from the original on 2 April 2015. Retrieved 2 March 2015.

- ^ Arturo Estrella and Tobias Adrian, FRB of New York Staff Report No. 397 Archived 2015-09-06 at the Wayback Machine, 2009

- ^ "Announcement Dates". US Business Cycle Expansions and Contractions. NBER Business Cycle Dating Committee. Archived from the original on 12 October 2007. Retrieved 1 March 2015.

- ^ Arturo Estrella, FRB of New York Staff Report No. 421 Archived 2013-09-21 at the Wayback Machine, 2010

- ^ George, Henry. (1881). Progress and Poverty: An Inquiry into the Cause of Industrial Depressions and of Increase of Want with Increase of Wealth; The Remedy. Kegan Paul (reissued by Cambridge University Press, 2009; ISBN 978-1108003612)

- ^ Ruhm, C (2000). "Are Recessions Good for Your Health?" (PDF). Quarterly Journal of Economics. 115 (2): 617–650. doi:10.1162/003355300554872. S2CID 51729569.

- ^ Perez, Carlota (March 2013). "Unleashing a golden age after the financial collapse: Drawing lessons from history". Environmental Innovation and Societal Transitions. 6: 9–23. Bibcode:2013EIST....6....9P. doi:10.1016/j.eist.2012.12.004. ISSN 2210-4224.

References[edit]

- Harvey, Andrew; Trimbur, Thomas (2003), "General model-based filters for extracting trends and cycles in economic time series" (PDF), The Review of Economics and Statistics, 85 (2): 244–255, doi:10.1162/003465303765299774, S2CID 57567527

- From (2008) The New Palgrave Dictionary of Economics, 2nd Edition:

- Christopher J. Erceg. "monetary business cycle models (sticky prices and wages)." Abstract.

- Christian Hellwig. "monetary business cycles (imperfect information)." Abstract.

- Ellen R. McGrattan "real business cycles." Abstract.

- Eckstein, Otto; Sinai, Allen (1990). "1. The Mechanisms of the Business Cycle in the Postwar Period". In Robert J. Gordon (ed.). The American Business Cycle: Continuity and Change. University of Chicago Press. ISBN 978-0226304533.

- Summers, Lawrence H. (1986). "Some Skeptical Observations on Real Business Cycle Theory" (PDF). Federal Reserve Bank of Minneapolis Quarterly Review. 10 (Fall): 23–27.

External links[edit]

- The Conference Board Business Cycle Indicators – Indicators of Euro Area, United States, Japan, China and so on.

- Historical documents relating to past business cycles, including charts, data publications, speeches, and analyses